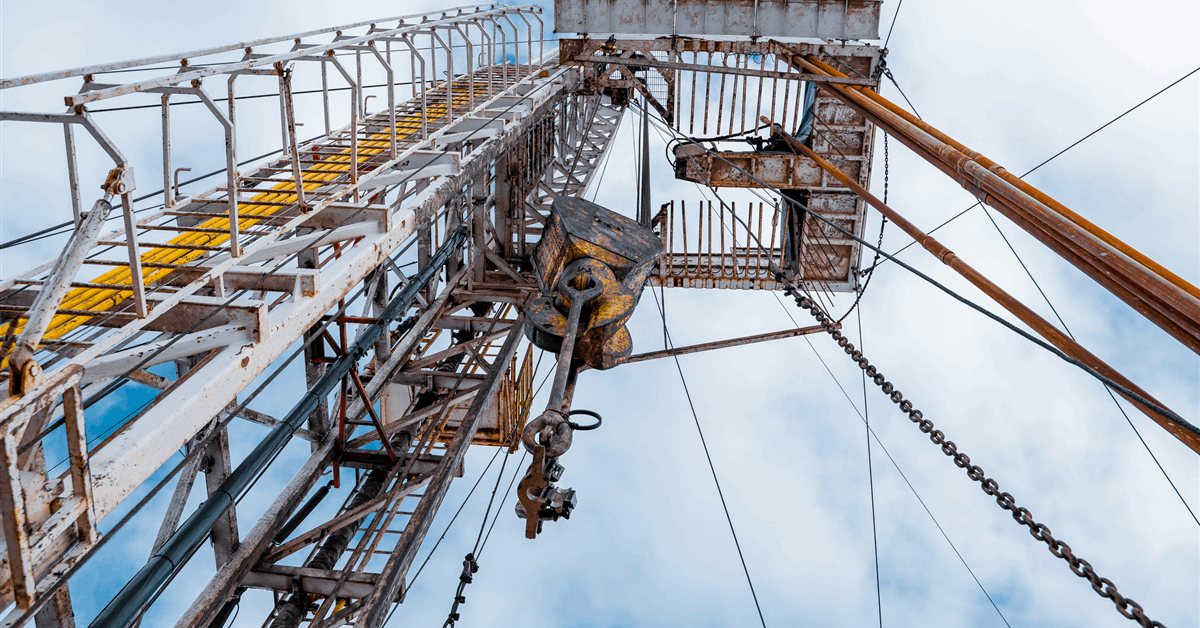

Tamboran Resources Corporation has reported that the Shenandoah South 2H sidetrack (SS-2H ST1) well achieved an average 60-day initial production (IP60) flow rate of 6.8 million cubic feet per day (MMcf/d), a Beetaloo Basin record.

“This result is a new Beetaloo Basin record and is more than double the previous IP60 record set by the SS-1H well in 2024,” Joel Riddle, Tamboran Chief Executive Officer, said in a stock filing.

Tamboran added that the exit rate maintains a steady, low-declining curve at 6.4 MMcf/d with a flowing wellhead pressure of 720 psi and has exhibited less decline than that of the SS-1H well over the last 30 days of testing. This also confirms the company’s view of commercial deliverability from the Beetaloo Basin to the Australian domestic East Coast gas market.

Tamboran also said it had commenced the three-well 2025 Shenandoah South Pilot Project drilling program with the spudding of the Shenandoah South 4H well. The wells are being drilled by the Helmerich & Payne super-spec FlexRig Flex 3 Rig from the SS2 pad in Exploration Permit 98.

“We have now commenced the largest planned drilling program in the Beetaloo Basin to date, with three wells to be drilled back-to-back with a total combined horizontal section of 30,000 feet”, Riddle said.

“These three wells are the last remaining wells required to be drilled as part of Tamboran’s commitment to deliver 40 MMcf/d to the local market under our gas sales contract with the Northern Territory Government. With over 90 percent of electricity in the Northern Territory market supplied from gas-fired power generation, our contract with the NTG is expected to play a major role in delivering energy security for all Territorians”, he said.

Tamboran said that through its subsidiaries, it is the largest acreage holder and operator with approximately 1.9 million net prospective acres in the Beetaloo Subbasin within the Greater McArthur Basin in the Northern Territory of Australia.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR