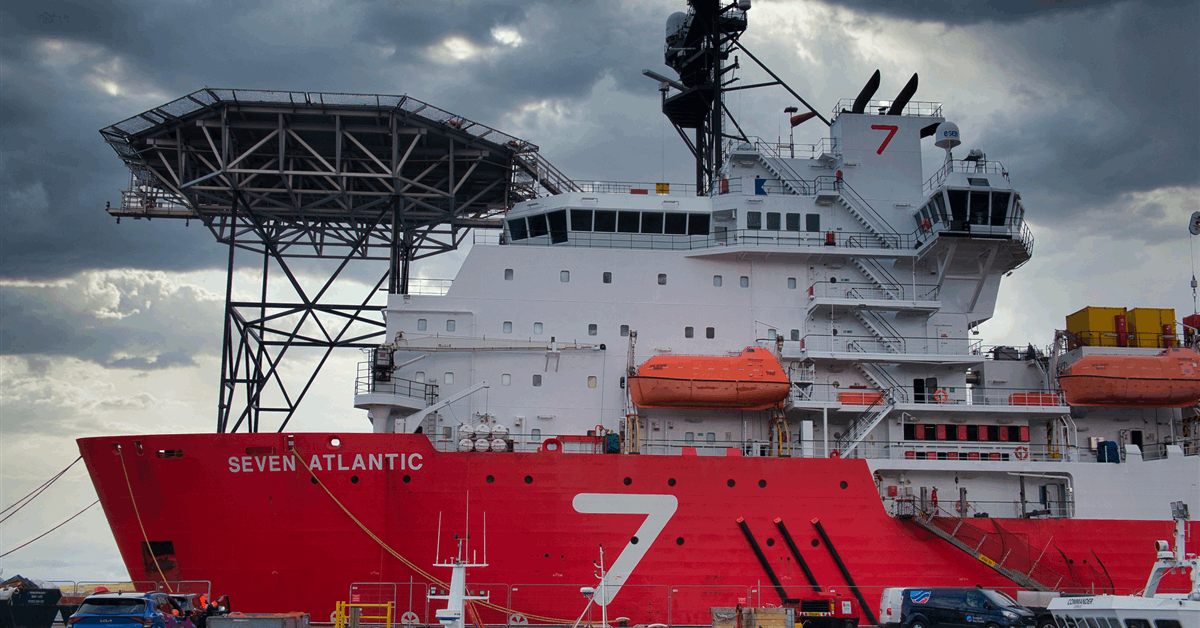

Subsea 7 S.A. has reported $1.5 billion in revenue for the first quarter (Q1), rising 10 percent compared to the corresponding period a year prior. Robust operational results in Subsea and Conventional, along with elevated activities in Taiwan’s renewables sector, helped counterbalance seasonal slowdowns and vessel upkeep, the company said.

Net financing expenses amounted to $17 million, coupled with a net loss from foreign exchange of $28 million, leading to a quarterly net income of $17 million, compared to $29 million for the same period last year, the company said.

Q1 order intake was $0.9 billion, including $0.4 billion in new awards and $0.5 billion in escalations, resulting in a book-to-bill ratio of 0.6 times. Backlog at the end of March was $10.8 billion, with $4.8 billion expected in 2025, $3.5 billion in 2026, and $2.5 billion in 2027 and beyond, Subsea 7 said.

“Subsea7 had a good start to 2025 with solid financial performance underpinned by strong project execution, which offset a heavy vessel maintenance schedule. The group reported 10 percent revenue growth year-on-year and Adjusted EBITDA margin expansion of 380bps, putting us on track to meet full-year expectations”, John Evans, Chief Executive Officer, said.

“Although uncertainty in the global economy has increased in recent months, the outlook for long-term energy demand growth remains positive. Subsea 7’s strategy to focus on long-duration developments in cost-advantaged sectors of the deepwater adds resilience to our subsea business, and our exposure to strategic gas developments, such as the Sakarya field in Türkiye, and new oil provinces such as Namibia gives us further confidence”, Evans added.

“In offshore wind, we are positive about the opportunities presented by this year’s CFD allocation round in the UK, where it is expected that the volume of projects sanctioned will nearly double year-on-year. We are well-positioned in this market, with a strong track record and collaborative client relationships”.

In the first quarter, Subsea 7 said it focused on planned vessel maintenance to prepare for a busy year while making progress on its subsea, conventional, and renewables projects. In Africa, Seven Arctic installed flexibles and umbilicals at Agogo, supported by Seven Borealis after its work in Saudi Arabia. Seven Pacific operated at the Raven field in Egypt before moving to Sakarya in Türkiye. In the Americas, Seven Oceans worked on multiple projects, including Sunspear and Salamanca in the U.S., while Seven Seas mainly focused on Cypre in Trinidad and Tobago, and Seven Vega continued rigid pipelay at Mero 3 in Brazil, the company said.

In Renewables, Seaway Strashnov and Seaway Alfa Lift completed maintenance before resuming work at Dogger Bank in the UK. The company has also installed a monopile gripper on Seaway Ventus, before the East Anglia Three project, where it will install 95 monopiles, and is active in Taiwan on Hai Long.

The company still expects revenue in 2025 to fall between $6.8 billion and $7.2 billion, with adjusted EBITDA margin projected to range 18-20 percent. Given its backlog of contracts and the opportunities in its bidding pipeline, Subsea 7 foresees margins surpassing 20 percent in 2026.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR