TechnipFMC PLC has posted a revenue of $2.23 billion for the first quarter, up 9.4 percent year-on-year (YoY), while net income fell 9.6 percent YoY to $142 million.

Included in total company results was a foreign exchange loss of $12.1 million, or $8.1 million after-tax, TechnipFMC said. Inbound orders during the quarter reached $3.08 billion, 11.3 percent up YoY, while total backlog hit $15.8 billion, 17.2 percent up YoY.

“Total company revenue in the period was $2.2 billion. Adjusted EBITDA was $356 million when excluding foreign exchange impacts, an increase of 38 percent compared to the prior year. Free cash flow was $380 million, which, together with our strong cash flow from operations, is a notable achievement in light of our typical seasonality”, Doug Pferdehirt, Chair and CEO, said.

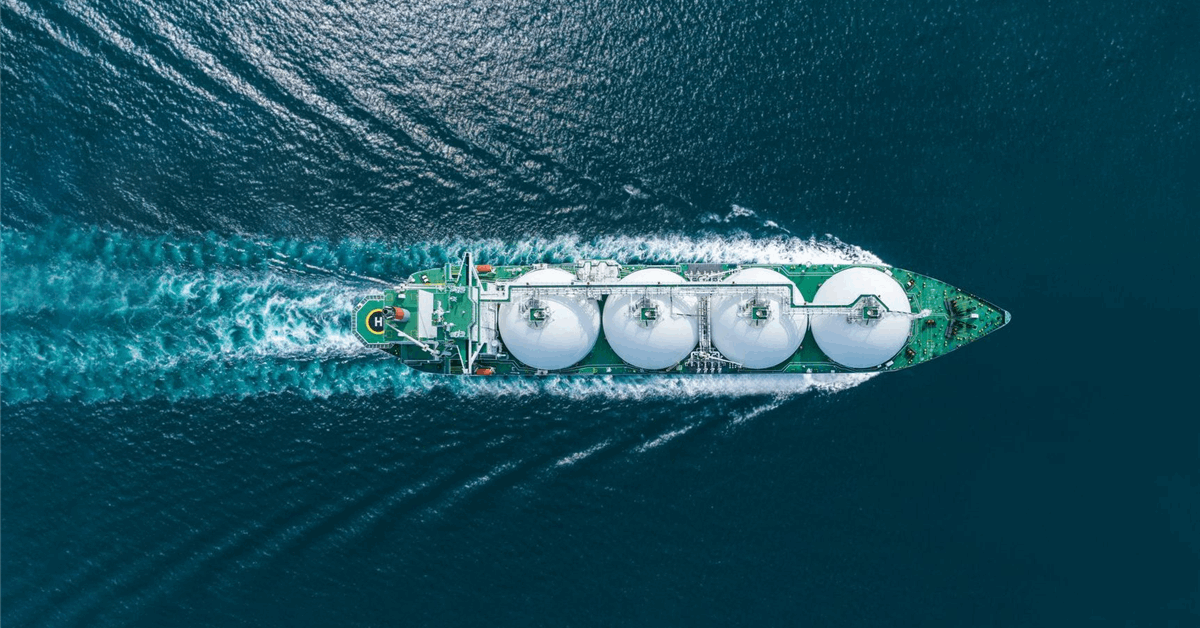

“Subsea inbound was $2.8 billion, representing a book-to-bill of 1.4x. Orders have now exceeded revenue in eight of the last nine quarters, supported by robust inbound for both integrated Engineering, Procurement, Construction, and Installation (iEPCI) and Subsea 2.0”, Pferdehirt said.

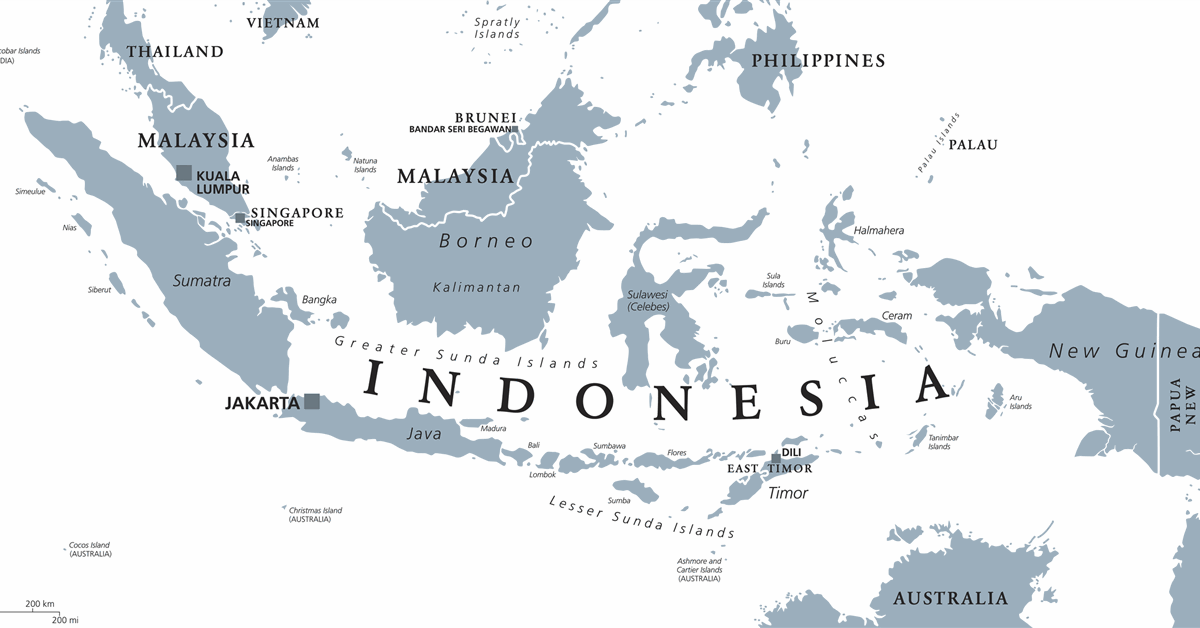

Subsea logged a first-quarter revenue of $1.9 billion, a decrease of 5.5 percent from the fourth quarter, the company said. Year-over-year revenue jumped 11.6 percent. The sequential decline resulted from decreased activity in Africa, the North Sea, and the Gulf of America, along with a drop in services activity attributed to normal offshore seasonality. This was somewhat balanced by an increase in project activity in Asia-Pacific and Brazil, the company said.

“Our Subsea Opportunities List now highlights more than $26 billion of inbound opportunities over the next 24 months, when using the midpoint of project values”, Pferdehirt said, adding that the opportunity set is also supported by multiple new frontiers, including Guyana, Suriname, Namibia, Mozambique, and Cyprus.

Surface Technologies reported a first-quarter revenue of $297.4 million, down 6.9 percent from the fourth quarter due to project timing in the Middle East and slower activity in Africa and Asia-Pacific, although North America saw increased activity. YoY, revenue slipped 3.2 percent.

“U.S. land is among the most susceptible regions to lower commodity prices, given its relatively high cost of development. The majority of activity in our Surface Technologies segment is driven by international markets, where we have secured significant inbound through the first four months of the year. Importantly, we estimate 95 percent of our total company revenue in 2025 will be generated from activity outside of the U.S. land market”, Pferdehirt added.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR