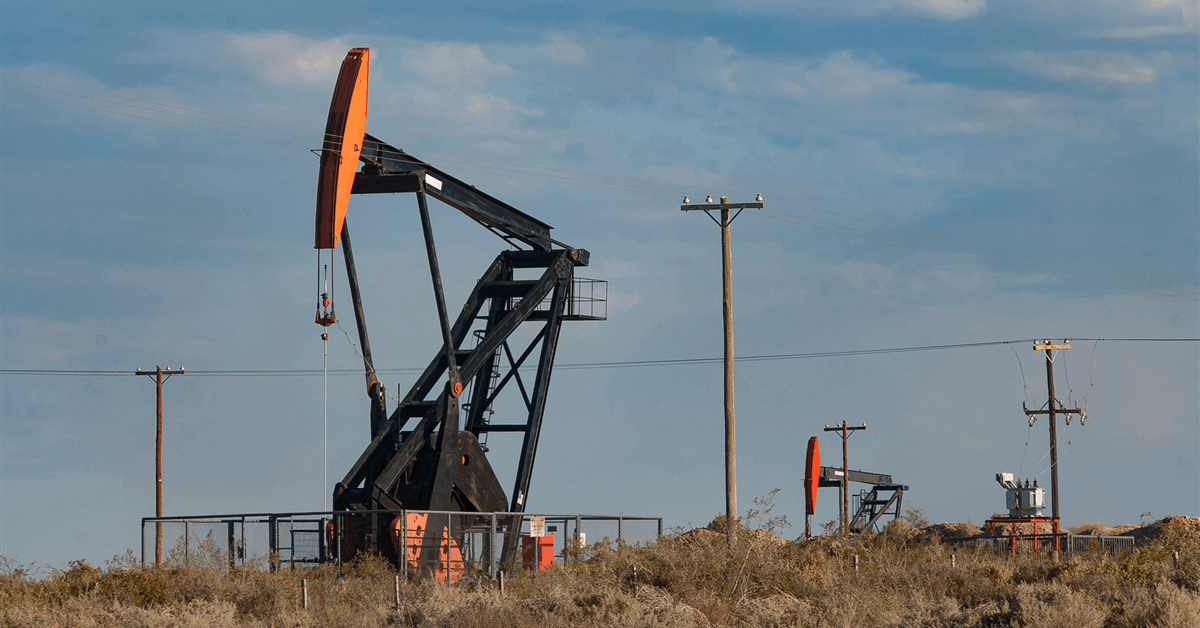

State-run Oil and Natural Gas Corp.’s quarterly profit declined on lower crude prices and stagnant production from its aging fields.

The New Delhi-based explorer’s net income fell 10% on year in the three months ended June 30 to 80.24 billion rupees ($915 million), according to a stock exchange filing. That was almost in-line with 80.74 billion rupees estimated by analysts, according to a Bloomberg survey.

The tepid earnings comes as the South Asian nation’s largest oil and gas producer is looking to cut dependence on exploration by diversifying into refining and liquefied natural gas. It is investing 2 trillion rupees on new energy offerings and emission control in its goal to become an integrated energy company.

ONGC’s weak June quarter performance contrasts with those of global peers like Exxon Mobil Corp. and Chevron Corp., which made up for weak crude prices with record production.

The company’s oil output increased just 1%, and gas production was flat as most of its older fields are witnessing a natural decline in performance.

To boost production, it will focus on recent discoveries and enhance recovery from aging fields, Chairman Arun Kumar Singh said in ONGC’s annual report published last week. The company is pursuing deepwater collaboration with global giants like BP Plc, ExxonMobil and TotalEnergies SE to mitigate exploration risks in difficult regions, he said.

ONGC, which accounts for two-thirds of India’s oil and more than half the gas output, saw its quarterly revenue fall 9.3% to 320 billion rupees. Its crude oil earnings per barrel plunged 20.4% to $66.13 a barrel, while that from gas rose 2.2% to $6.64 per million British thermal units.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.