TotalEnergies SE and NEO NEXT Energy Ltd, recently created by Repsol UK Ltd and HitecVision AS, have entered into a deal to combine their exploration and production assets in the United Kingdom and thereby create what they say would be the top producer in the UK North Sea.

France’s TotalEnergies would own 47.5 percent of the resulting company, to be called NEO NEXT+. Norway-based HitecVision, a capital investor in Europe’s energy sector, and Repsol UK will retain 28.88 percent and 23.63 percent respectively, according to online statements by the parties.

Repsol UK is 75 percent owned by Spanish integrated energy company Repsol SA and 25 percent owned by the United States’ EIG Global Energy Partners, which acquired a 25 percent stake in Repsol SA’s entire upstream portfolio in 2023 for $4.8 billion.

HitecVision and Repsol UK had merged their North Sea assets into NEO NEXT earlier this year with interests of 55 percent and 45 percent respectively.

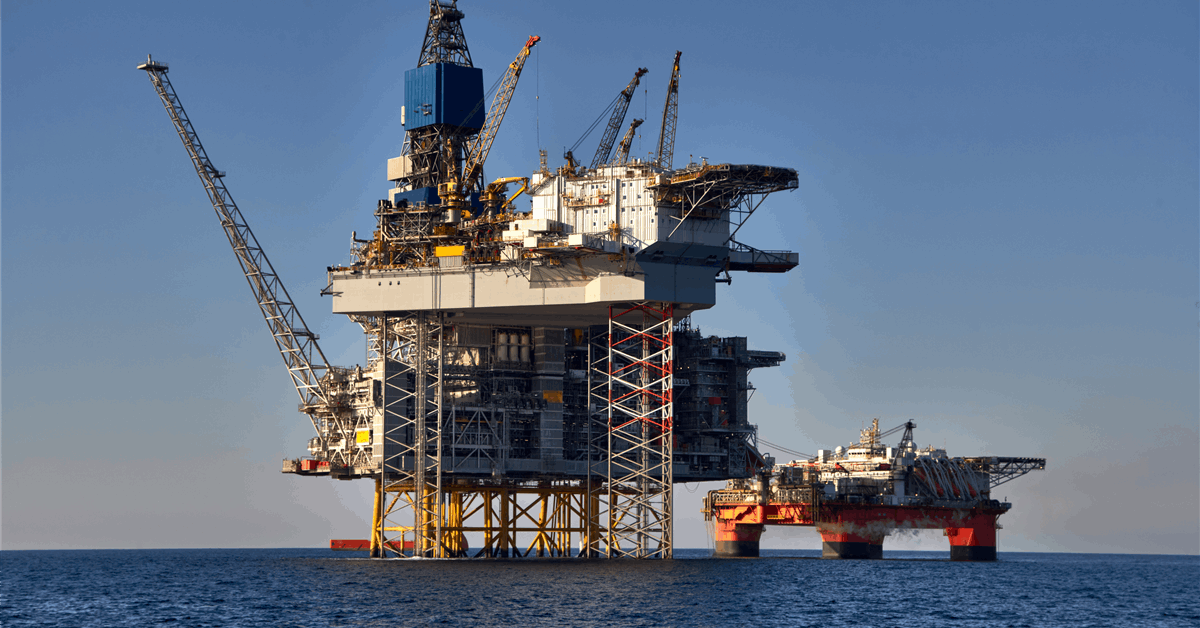

NEO NEXT+ would “encompass a large and diverse asset portfolio including notably NEO Energy’s [HitecVision subsidiary] and Repsol UK’s interests in the Elgin/Franklin complex and the Penguins, Mariner, Shearwater and Culzean fields, enriched by TotalEnergies’ UK upstream assets, notably including its interests in the Elgin/Franklin complex and the Alwyn North, Dunbar and Culzean fields”, TotalEnergies said in a statement on its website.

“With TotalEnergies as its leading shareholder, NEO NEXT+ will become the largest independent oil and gas producer in the UK with a production over 250,000 barrels of oil equivalent per day in 2026, ideally positioned to maximize the value of its portfolio, deliver strong financial returns and ensure a long-term sustainable and resilient future for its oil and gas business”, TotalEnergies said.

TotalEnergies’ upstream portfolio in the UK averaged 121,000 barrels of oil equivalent a day (boed) last year, accounting for about 27 percent of the UK continental shelf’s gas production, the statement noted.

NEO NEXT said separately, “The addition of TotalEnergies UK’s operated high-quality producing assets will strengthen NEO NEXT’s balance sheet, reinforce its operational capabilities and support its development activities, ensuring a long-term sustainable and resilient future for its oil and gas business in the UK”.

“TotalEnergies UK will also retain up to $2.3 billion of the decommissioning liabilities related to its legacy assets, enhancing the cash flows of the combined business”, NEO NEXT added.

The parties expect to complete the merger in the first half of 2026, subject to customary conditions.

NEO NEXT executive chair and HitecVision senior partner John Knight said, “As a leading global offshore operator, TotalEnergies adds significant operational capabilities across project management, especially in high-pressure/high-temperature gas production operations and a global experience of offshore operations”.

“The enlarged NEO NEXT+ business also has an enhanced portfolio of potential near-term development opportunities”, Knight added.

Repsol SA chief executive Josu Jon Imaz said, “With complementary shareholder strengths and a broader, balanced portfolio under greater operational control, we will be well-positioned to compete and adapt in the UK North Sea. With this deal, we continue to optimize our global asset portfolio with a focus on high-margin projects to sustain business scale in the medium and long term and enhance shareholder value”.

TotalEnergies chair and chief executive Patrick Pouyanné said, “This transaction demonstrates the long-lasting commitment of TotalEnergies towards the UK oil and gas sector and its energy security. As the new largest shareholder of NEO NEXT+, we are excited to bring along our recognized track record as a leading operator in the UK North Sea, where we have been present for more than 60 years”.

To contact the author, email [email protected]