54.5 GW

Total bookings backlog through 2030.

3.7 GW

Capacity of new U.S. production facility slated for late 2026.

68.2 GW

Total North American booking opportunities, out of 79.2 GW globally.

In its third-quarter earnings presentation Thursday, First Solar listed a half-dozen “headwinds” for solar panel components manufactured abroad and shipped into the United States. Those include the possibility of new Section 232 tariffs on imported polysilicon components, potential retroactive duties on certain imports between June 2022 and June 2024 following an August trade court ruling, and pending Treasury Department guidance on domestic content in clean energy equipment.

In a statement Thursday, First Solar CEO Mark Widmar said his company’s domestic supply chain positions it to benefit from trade friction.

“While trade and policy developments have introduced new challenges for many in our industry, we continue to differentiate ourselves by offering pricing and delivery certainty,” he said.

He added more color to that statement on First Solar’s Thursday afternoon investor call.

“We believe this enhances the value proposition of our vertically integrated facilities … and of expanding our U.S. manufacturing and production [while] reshoring supply chains,” Widmar said.

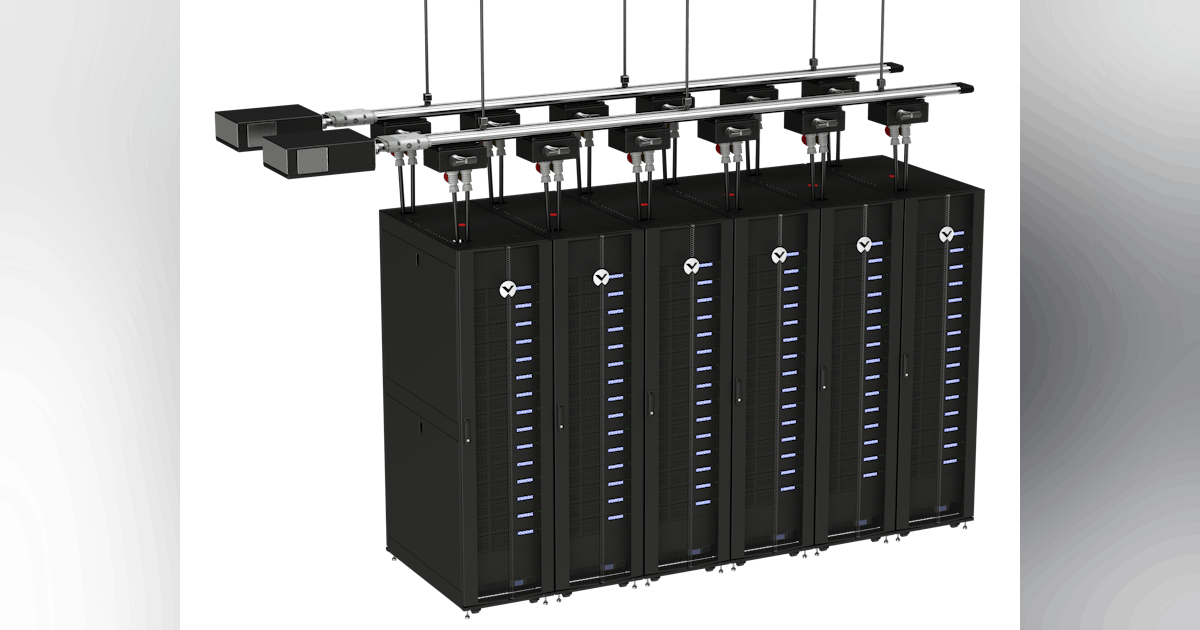

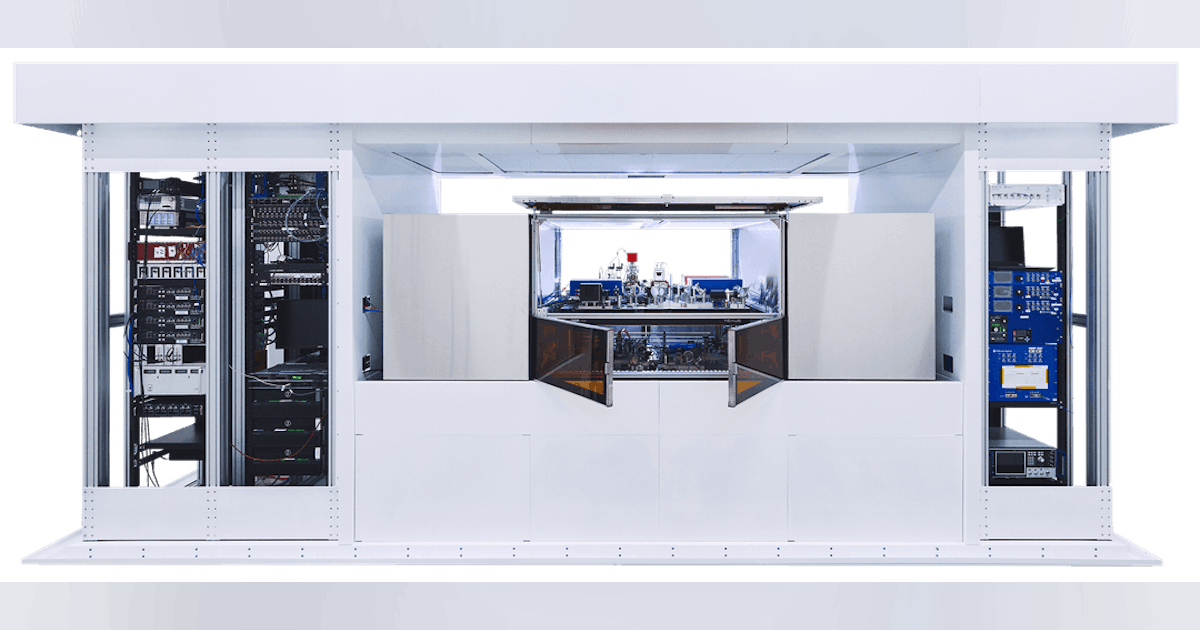

Manufacturing update

First Solar produced 3.6 GW of solar equipment in the third quarter, 2.5 GW of which came from U.S. factories. Its newest production facility came online in Louisiana in August, and the company plans to commission new finishing lines with 3.7 GW annual capacity at a location to be announced soon, First Solar said Thursday.

On Thursday, Widmar signaled more U.S. investment could follow as First Solar shifts production out of heavily tariffed markets in Southeast Asia.

“We are very excited about getting the first two lines up and running here next year … as we continue to evaluate market opportunities and demand, more decisions will be made,” he said.

BP Lightsource contract dispute

First Solar continues to enforce its contractual rights against Lightsource BP, Widmar and First Solar Chief Financial Officer Alexander Bradley said on Thursday.

The European renewables developer, a subsidiary of BP, terminated a 6.6-GW supply agreement with First Solar last year amid what Widmar said was a broader retreat from renewable energy development by oil-and-gas multinationals.

First Solar booked $61 million in revenue from the contract but seeks an additional $324 million in damages, Bradley said. He did not say when First Solar expects the case to be resolved.

Solid bookings, pipeline churn

First Solar has 54.5 GW of net bookings out to 2030, the company said Thursday. Bradley characterized the pipeline as healthy, driven by continued strong demand in the United States. The Lightsource BP termination accounted for the bulk of recently canceled volumes, and at least one large customer re-booked an order in 2025 after canceling in 2024, Bradley added.

But in a Friday note to First Solar investors, William Blair stock analyst Jed Dorsheimer said more cancellations could be on the way and advised investors to scrutinize First Solar’s backlog more closely.

The pipeline churn “reflect[s] a broader hesitation in the corporate energy transition” that should push First Solar “to recalibrate expectations around demand from sectors once seen as key drivers of clean energy adoption,” Dorsheimer said.

For now, First Solar investors appear unbothered. First Solar stock gained 13% in Friday morning trading, notching a 52-week high.