Treasury Secretary Scott Bessent is set to travel to Ukraine this week as part of initial discussions to secure US access to critical minerals, according to people familiar with the matter who spoke on condition of anonymity.

Bessent, who will be the first member of Donald Trump’s cabinet to visit the country is making the trip to Kyiv days after the president said his administration wanted an agreement with Ukraine for access to the resources in return for aiding in its defense against Russia’s invasion.

A White House spokesperson declined to comment.

Ukrainian President Volodymyr Zelenskiy told reporters in Kyiv earlier Monday that he planned to meet with “serious people” from the Trump administration in Ukraine before the Munich Security Conference, which begins on Friday.

Zelenskiy has suggested willingness to an agreement securing more US backing in exchange for some of Ukraine’s rare earths and other minerals. “If we are talking about a deal, then let’s do a deal, we are only for it,” he told Reuters in an interview published last Friday.

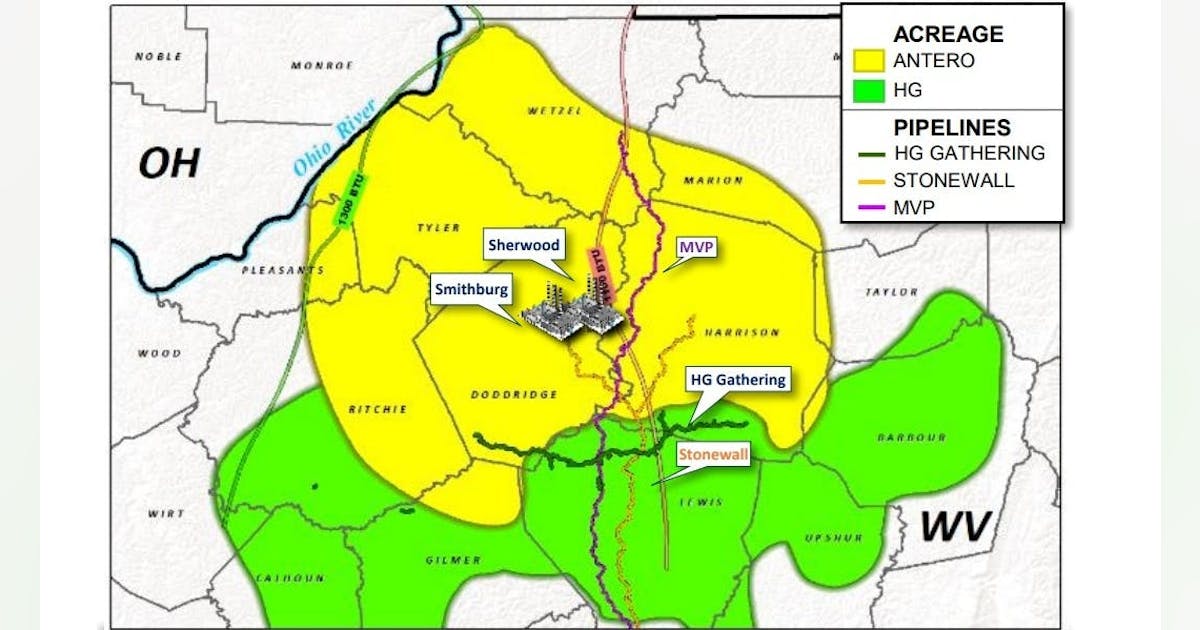

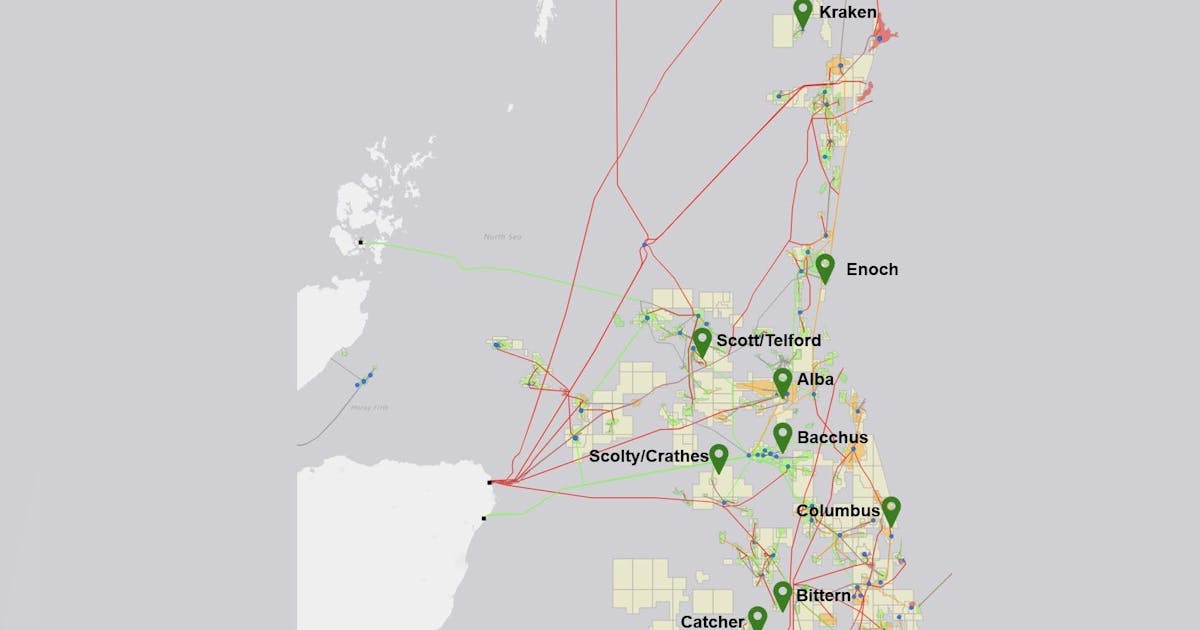

Ukraine holds significant reserves of uranium and several critical minerals including titanium, lithium, and graphite. The Kyiv government estimates that they could be worth trillions of dollars.

Mike Waltz, Trump’s National Security advisor, said Sunday that the future of Ukraine’s aid would be discussed this week.

“We need to recoup those costs and that is going to be a partnership with the Ukrainians in terms of their rare earths, their natural resources and their oil and gas, and also buying ours,” Waltz told NBC’s Meet the Press. “Those conversations are going to happen this week.”

Trump’s envoy for Ukraine and Russia, retired general Keith Kellogg, plans to present Trump with options in the coming weeks to end the war, according to people familiar with the matter.

Kellogg plans to gather input from officials at the Munich Security Conference, and during visits to Kyiv and other European capitals, said the people, who asked not to be identified as the plans aren’t public.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR

Bloomberg