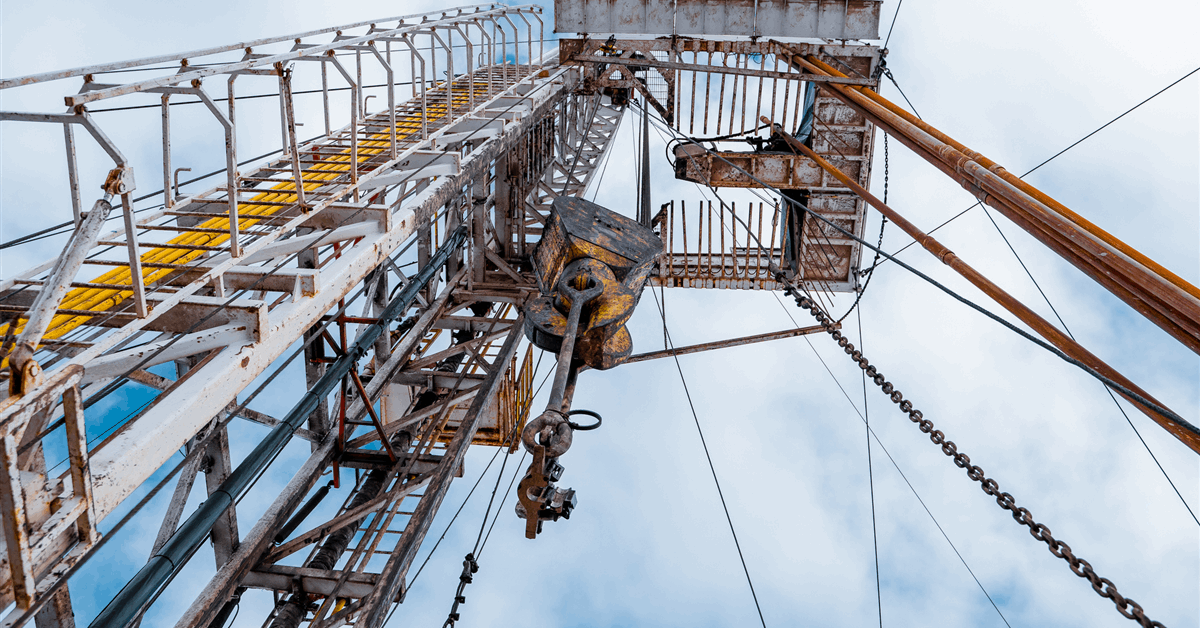

Absent greater military involvement, the Trump administration has limited leverage over Russia without risking a spike in oil prices.

That’s what J.P. Morgan analysts, including Natasha Kaneva, head of global commodities strategy at the company, said in a J.P. Morgan research note sent to Rigzone by Kaneva on August 8.

“At the same time, low oil prices will negatively affect the Russian economy,” the analysts said in the note.

The analysts went on to state that Russia can expand its shadow fleet to bypass sanctions but added that opportunities are becoming more limited .

“The country needs around 240 Aframax to transport 3.5 million barrels per day of crude,” the J.P. Morgan analysts said.

“Currently, about 99 tankers older than 20 years have a high likelihood of transitioning to the shadow fleet and 155 tankers aged 15-20 years … have a moderate likelihood of being converted,” they added.

Rigzone has contacted the White House and the Department of Information and Press of the Russian Ministry of Foreign Affairs for comment on J.P. Morgan’s research note. At the time of writing, neither have responded to Rigzone.

In a separate J.P. Morgan research note sent to Rigzone by the JPM Commodities Research team late Monday, J.P. Morgan analysts said the estimated value of open interest in energy markets declined by $19.5 billion week on week and has reverted to ten week lows of $622 billion amid price weakness across crude markets.

“Contract based flows were largely muted on the week at -$1.1 billion week on week across the sector, as -$3.8 billion week on week of outflows from refined product markets were mostly offset by inflows to natural gas markets of $2.7 billion week on week,” the analysts said in that note.

In an oil and gas report sent to Rigzone by the Standard Chartered team late Tuesday, analysts at Standard Chartered Bank said Brent crude prices drifted lower on the week amid thin trading conditions.

“October Brent settled close to our machine learning model SCORPIO’s forecast of an 11 August settlement of $67.00 per barrel, at $66.63 per barrel; a week on week fall of $2.13 per barrel,” the analysts said in the report.

“The model sees $67 per barrel as a comfortable target in the near term, forecasting a modest $0.42 per barrel rise week on week to an 18 August settlement of $67.05 per barrel,” they added.

The Standard Chartered Bank analysts went on to state in the report that money-manager positioning in crude has moved further to the short side for all energy products over the past week.

“The Standard Chartered combined crude index fell by 10 week on week to -30, with WTI down 9.7 week on week to -79.0 and Brent down 5.8 week on week to 32.1,” they said.

“While heating oil remains the most popular energy product in our survey at +64.5, it fell by 34.7 week on week,” they added.

A Stratas Advisors report sent to Rigzone by the Stratas team on Monday highlighted that the price of Brent crude ended the week at $66.32 per barrel after closing the previous week at $69.67 per barrel.

“The price of WTI ended the week at $63.35 after closing the previous week at $67.33. The price of Oman crude oil ended the week at $68.50,” the report pointed out.

In that report, Stratas warned that “more downside is likely”.

J.P. Morgan describes itself on its site as a leading global financial services firm with assets of $3.9 trillion and operations worldwide. Standard Chartered states on its site that it is “a global bank connecting corporate, institutional and affluent clients to a network that offers unique access to sustainable growth opportunities across Asia, Africa and the Middle East”. On its website, Stratas describes itself as a global consultancy that “provides full spectrum coverage of the energy sector and related industries”.

To contact the author, email [email protected]