Storegga has “dramatically” slowed down spending in the UK amid delays to funding for the Acorn carbon capture and storage (CCS) project in Scotland.

It comes amid claims from the SNP Westminster leader Stephen Flynn that Scotland is being treated as an “afterthought” over delays to Acorn.

Speaking to Energy Voice, Storegga chief executive Tim Stedman said the company is allocating more resources to projects in Norway and the United States amid continued uncertainty for the Acorn.

Stedman also warned that if Acorn does not go ahead, it “would have fairly major ramifications” for Scotland’s ability to decarbonise its existing heavy industries.

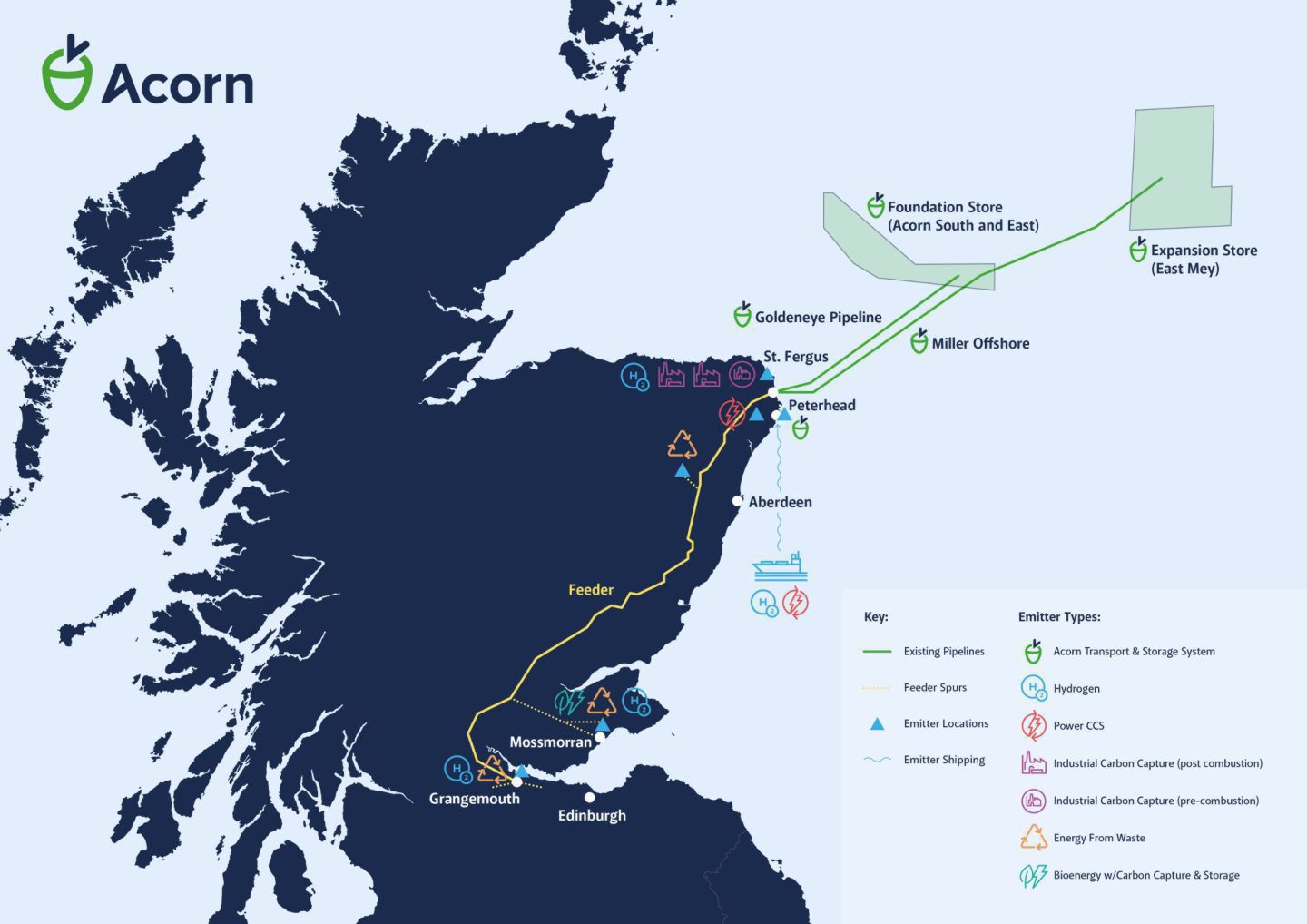

Backed by Storegga alongside North Sea operators Shell, Harbour Energy and North Sea Midstream Partners, the Acorn project is aiming to decarbonise industrial emitters across Scotland.

The industrial sites included in the Scottish Cluster emit an estimated 9.3 million tonnes of CO2 per year, accounting for around 80% of Scotland’s industrial emissions.

After capturing industrial emissions, the Acorn partners will transport the CO2 to Peterhead via repurposed pipelines for permanent offshore storage.

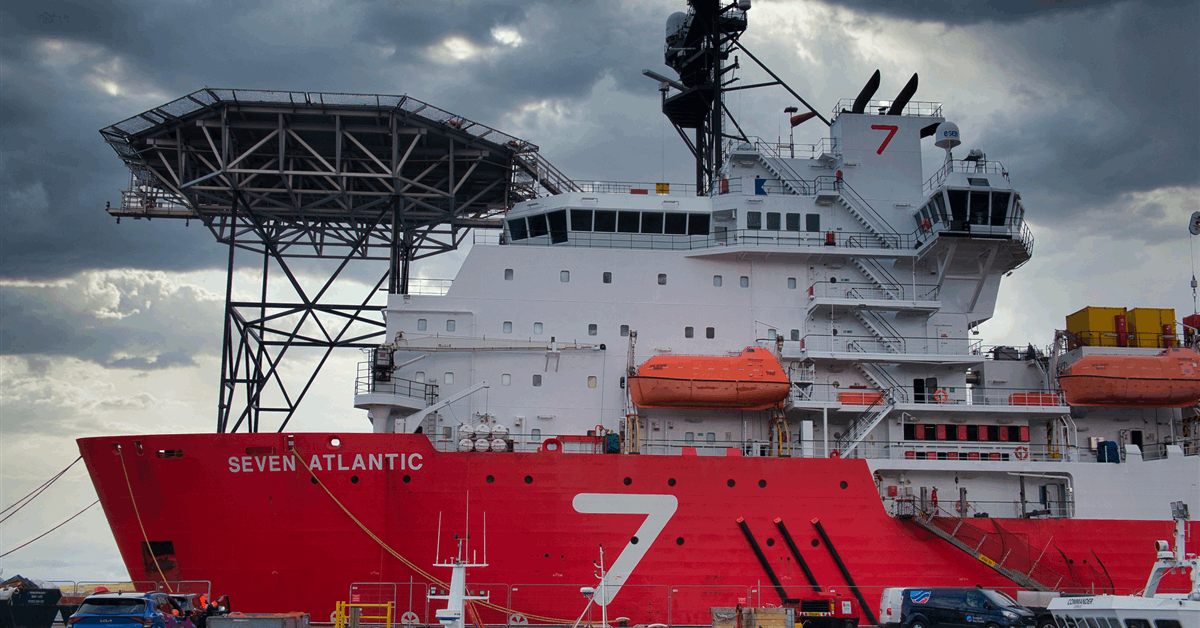

In addition, the Acorn developers are also exploring options to receive CO2 shipments by sea at Peterhead.

A report released last year estimated the Acorn project and Scottish Cluster could bring an estimated £17.7 billion in economic benefit to the UK economy by 2050.

Track-1 and Track-2 Clusters

Acorn received initial UK government funding in 2023 when it was shortlisted for so-called Track-2 status alongside Harbour Energy’s Viking CCS project in the Humber.

But since 2023, the Track-2 projects have endured months of uncertainty around future government support.

Meanwhile, the two Track-1 CCS projects in north west and north east England are moving ahead after Labour committed £22bn last year.

Stedman said while the news that the Track-1 East Coast Cluster and HyNet North West projects are proceeding is “definitely worth celebrating”, he warned Acorn and Scotland “must not be forgotten”.

“Uncertainty is always the enemy of business, and so the fact that we are waiting in an uncertain period, looking ahead to the [Treasury’s] comprehensive spending review is something that we would ideally like to get through as quickly as possible,” he said.

© Supplied by Storegga

© Supplied by Storegga“For Scotland, Acorn is the decarbonisation route for industry, and if we want an industrialised future, if we want those jobs, if we want that benefit, then we have to have Acorn.

“We want to make sure that Scotland is not forgotten, and that we are driving towards that end.”

Stedman said altogether, the Acorn partners have already spent close to £90 million on developing the project.

“That’s a huge amount of money waiting for certainty on a project where the [existing] infrastructure is not getting any newer, where the challenges of a competitive world are not getting any easier, and where, frankly, the money can flow and be spent somewhere else with fewer levels of uncertainty,” he said.

UK falling behind Norway and US on CCS

Alongside Acorn, Storegga is also pursuing other CCS projects, including Trudvang in Norway and Harvest Bend in the US.

The company is also collaborating with oil and gas firms Petronas and Adnoc to assess CCS opportunities in the Penyu basin offshore Malaysia.

But with the Acorn project facing delays as a result of the UK’s regulated business model for CCS, Stedman said Storegga is focusing more on Norway and the US.

While Stedman said the UK model is a “good model in many ways”, he said it is “phenomenally expensive from a government accounting point of view”.

It is also “very, very time-consuming to go through”, he added.

By contrast, the US and Norway are prioritising models focused on tax incentives and government subsidies, which Stedman said is allowing projects to reach FID “much faster”.

© Leon Neal/PA Wire

© Leon Neal/PA WireStedman said Storegga is advocating for aspects of the Norwegian and US models to be applied to the next round of CCS developments in the UK following Track-2.

“We need to learn from other business models and other regulatory regimes to end up with something that is sufficiently agile that it can actually develop business and allow business to grow rapidly,” he said.

“And the current regulated model as it is today, I think you would look at it and say that it is not moving forward with the same pace as Norway and the US.”

‘Remonetising the North Sea’ through CCS

As a result, Storegga has “slowed down spending in the UK dramatically in CCS”, Stedman said.

“It is shifting from the UK to those other countries and regions,” he said.

“We need clarity and certainty in the UK in order to reverse that flow and bring resources and spend back to those UK projects.”

Stedman said Norway’s approach is also allowing it to address the “very substantial” CO2 emissions from heavy industries in north-west Europe.

“If you take the size of the cement and steel industries in Germany, Holland and Belgium, and compare it to the UK, it is massively larger, five to six times larger,” he said.

© Supplied by Shell

© Supplied by Shell“That’s five to six times more CO2, and those are the industries that are typically considered the low-hanging fruit for the first stage of CCS.

“The fact that Norway has been able, with their model, to go after those volumes and to address that pressing need for decarbonisation in those industries has allowed them to move quite fast, because you need a certain volume to get a financial investment decision away.”

International CO2 shipments

While Norway has secured bilateral agreements with several EU nations covering cross-border CO2 shipments, the UK has yet to agree similar deals.

For Storegga, the so-called ‘merchant model’ of securing international shipments is a way of “remonetising the North Sea” and providing revenue certainty for Acorn, alongside domestic transfers from proposed CCS projects in Wales and Severnside.

Other North Sea operators, including EnQuest, Eni and Perenco, are also developing future offshore CCS projects which involve international CO2 shipments.

“That is a natural evolution of the current regulated model that the UK could consider learning from Norway to be able to actually accelerate development,” he said.

“As you build the scale, you drive the unit cost down, it becomes something that is effectively a route to remonetising the North Sea, and that’s what we’ve got to recognise.

“We have 40% of Europe’s CO2 storage capacity and we’re looking at how we unlock that.”

While Norway and Denmark are moving ahead with early stage projects like Northern Lights and Project Greensand, Stedman said it will take “the whole of the North Sea” to decarbonise Europe.

Future of Grangemouth and Scottish CCS

Stedman said delivering the Acorn project is also crucial for the future of Scotland’s industrial sites like the Grangemouth refinery, which ceased operations this week.

While he welcomed efforts from the UK and Scottish governments to chart a future path for Grangemouth through Project Willow, Stedman said there needs to be a holistic approach which includes Acorn.

“There is a project on project risk here, which needs to be addressed, and the only way of doing it is to start eating away at that systematically,” he said.

Meanwhile, the head of Scottish carbon capture alliance NECCUS also called on the UK government to provide clarity for Acorn and Viking.

Speaking to Energy Voice, NECCUS chief executive Dr Philippa Parmiter said progress on Track-1 projects is giving the industry “hope that we will finally see a live project in Scotland”.

However, Dr Parmiter said the industry is “well aware that there are fiscal challenges for government”.

But she warned that the Acorn partners have already invested “many millions” and said “pushing the timeline even further to the right would not be helpful”.

“It is key that Storegga and the Scottish Cluster receive some clarity on timelines and funding in the Comprehensive Spending Review in June,” she added.

Alongside decarbonising existing industries, Dr Parmiter said advancing the Track-1 and Track-2 projects will give a boost to emerging industries such as eFuels, green maritime fuels and sustainable aviation fuels.

“Most of the cluster project modelling indicates that we will see not only tens of thousands of retained jobs, but also tens of thousands of new jobs,” she said.

“We have seen from Project Willow on the key technologies that will enable Grangemouth to develop as a low-carbon manufacturing hub – many of these technologies need CCUS infrastructure to be in place.”