Dive Brief:

- Nuclear reactor restarts and capacity uprates could get a financial lift in 2025 and onward from the Inflation Reduction Act’s technology-neutral Section 45Y production and Section 48E investment tax credits and Section 45V clean hydrogen production tax credits, though recent Treasury Department guidance leaves some questions unanswered and executive-branch reforms could affect Nuclear Regulatory Commission activities, Morgan, Lewis & Bockius attorneys said Wednesday on the law firm’s Q1 2025 nuclear regulatory webinar.

- To qualify for the credits, restarted nuclear reactors must have ceased operations for at least one calendar year, be authorized to restart by federal nuclear and energy regulators, and meet an “anti-abuse” test meant to prevent reactors from shuttering to later qualify for federal tax credits, Morgan Lewis attorney Jared Sanders said on the webinar.

- Absent incremental capacity uprates, existing nuclear generation facilities are not eligible to claim the technology-neutral production or investment tax credits and can only claim the 45V tax credit up to a maximum of 200 MW under certain conditions, Sanders said.

Dive Insight:

Since 2023, the owners of three prematurely retired nuclear power plants have announced plans to restart operations by the end of the decade: Holtec International’s Palisades plant in Michigan, Constellation Energy’s Three Mile Island Unit 1 in Pennsylvania, and NextEra Energy’s Duane Arnold facility in Iowa.

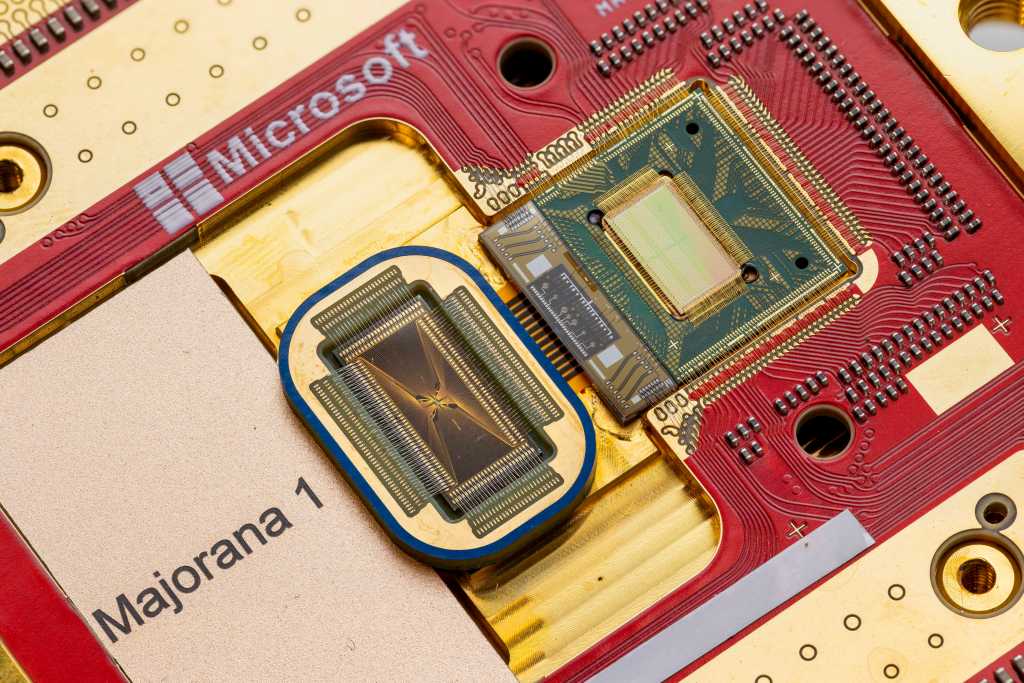

TMI Unit 1 — now known as the Crane Clean Energy Center — ceased operations in 2019. Duane Arnold shuttered in 2020, followed by Palisades in 2022. All are likely to qualify for federal tax credits, though Constellation spokesperson Paul Adams told Politico last year that it was the company’s 20-year power purchase agreement with Microsoft, not federal tax credit eligibility, that made the restart possible.

Holtec also plans to bring two 300-MW SMRs into operation at the Palisades site in the early 2030s. As new nuclear facilities, those would likely qualify for federal tax credits under current Treasury guidance, as would the approximately 2 GW to 8 GW of potential capacity uprates the U.S. Department of Energy identified last year across the 94-reactor U.S. commercial nuclear fleet.

None of the recommissioning owners have discussed hydrogen production, but at least two operational nuclear power stations — Vistra’s Davis-Besse facility in Ohio and Xcel Energy’s Prairie Island plant in Minnesota — may host hydrogen demonstration projects as soon as this year, DOE said in January.

It’s unclear whether either plant would qualify for the Section 45V credit under current Treasury guidance. A qualifying facility must be a merchant generator or single-unit plant not colocated with another reactor and demonstrate “that it is at risk for retirement and dependent on hydrogen production to remain in operation,” according to the webinar presentation.

The final Treasury regulations for Sections 45Y and 48E were “silent” on some outstanding questions, such as whether reactor fuel and certain components qualify, Sanders said.

Also left outstanding was any guidance for the IRA’s Section 45U tax credit, which authorizes a base credit of 0.3 cents/kWh for electricity produced by conventional nuclear power plants placed into service before Dec. 31, 2023. The Biden Treasury never proposed or finalized 45U regulations, and “one could anticipate that they’re unlikely to be a regulatory priority” under the new administration, Sanders said.

The nuclear industry now awaits clarity on the fate of all nuclear-related IRA tax credits as Congress and the White House work toward a deal to extend tax cuts passed during the first Trump administration, Sanders said. Though the second Trump administration’s day-one “Unleashing American Energy” order mentioned nuclear as a favored energy source, Congressional Republicans’ offset menu includes an option to fully repeal the IRA, he said.

The nuclear industry also awaits clarity on a potential reduction in force in the U.S. Nuclear Regulatory Commission and the implications for NRC of President Trump’s Feb. 18 executive order limiting the autonomy of executive-branch agencies, said Morgan Lewis attorney Scott Clausen.

The order requires federal agencies to “submit draft regulations for White House review — with no carve-out for so-called independent agencies” and “consult with the White House on their priorities and strategic plans,” with the Office of Management and Budget exercising budget oversight and the U.S. Attorney General “interpret[ing] the law for the executive branch, instead of having separate agencies adopt conflicting interpretations.”

The order leaves some important questions unresolved, like whether NRC’s regulatory actions must be cleared with the Department of Justice, Clausen said. A more streamlined regulatory process “would be a positive for the industry,” but a review process involving other executive-branch agencies could also create bottlenecks, he said.