Government will either listen and change – or will “prematurely bring an end to the North Sea”, a union official has said.

When asked if recent announcements of oil and gas job cuts will prompt government support, union leader John Boland responded “honestly, no.”

Last week saw the latest announcement of job cuts from the oil and gas sector as the UK’s largest operator unveiled plans to slash its Aberdeen headcount by a quarter.

The decision to cut 250 of Harbour Energy’s 1,000-person workforce came down to the impacts of the country’s fiscal regime and government dithering with regards to the allocation of carbon capture storage (CCS) funds.

However, headlines of operators moving overseas, downgrading investment in the UK, cutting domestic jobs and stalling projects is not something that started with Harbour Energy last week.

A string of operators have shared the consensus that the current headline rate of tax, imposed at 75%, and uncertainty over continued oil and gas licencing has resulted in upset across the industry.

Last year, Apache announced it would be vacating the UK by the end of the decade, merger deals to consolidate UK assets and derisk international portfolios have become commonplace and redundancies have continued to make headlines as a result.

‘Everything seems to be getting cut back’ as contractors suffer

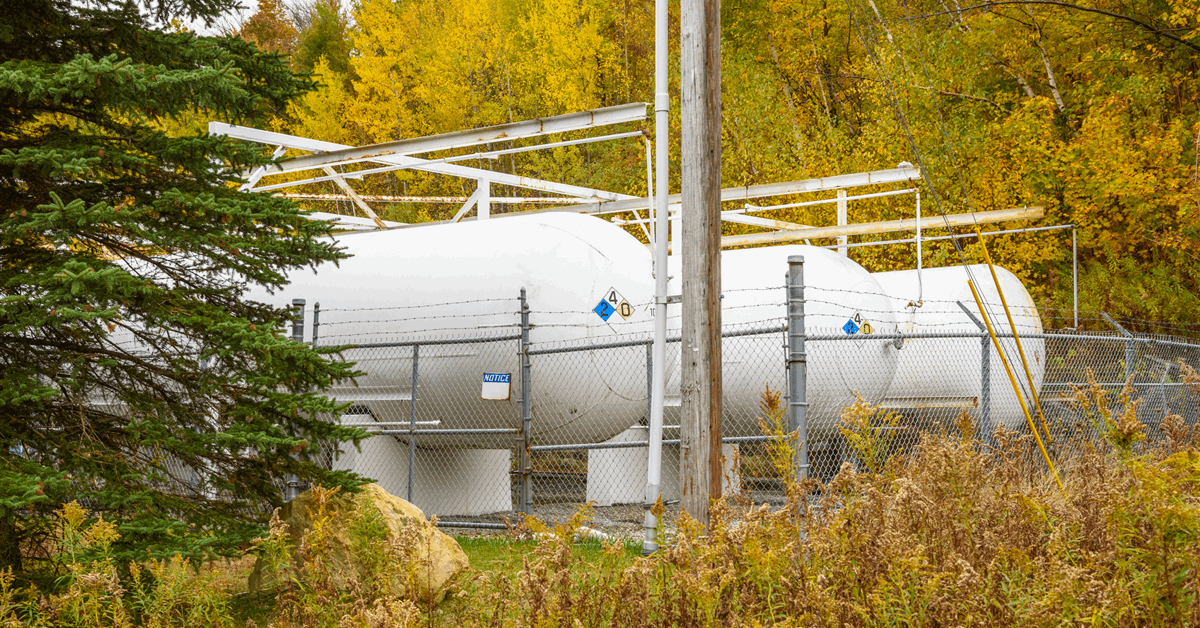

© Supplied by Kami Thomson/DC Thom

© Supplied by Kami Thomson/DC ThomWavering certainty around future UK operations are also impacting the supply chain as tenders for maintenance work, which have historically been rife at this time of year, have also dried up, according to Unite the Union.

The union’s regional officer told Energy Voice: “Say we looked pre-covid, there’d be employment for people offshore all over the place, there’d be lots of ad hoc getting employed.

“There’d be shutdowns planned, and this comes into the maintenance thing, we’re not seeing that now. What used to be is you’d maybe have a 60-day tar [shut down for maintenance], you’re seeing a 10-day tar now.

“Everything seems to be getting cut back and instead of bringing in a flotilla for accommodation, for bringing people to do the work, they’re just trying to do it with the existing workforce that they’ve actually got there.”

This has a knock-on effect on contractors and suppliers as North Sea operators aim to squeeze overheads in a fiscally hostile climate.

Struggling Petrofac was named by the union leader as a firm that is seeing the impacts of firms slashing contractor budgets.

© Supplied by Petrofac

© Supplied by PetrofacIn March, Repsol UK blamed UK government tax “policies and adverse economic conditions” as it confirmed plans to cut jobs in the North Sea.

The operators confirmed that 21 in-house roles could be cut although it did not confirm how many jobs would have to go as it announced its “new and more efficient operating model”.

In addition to this, it said that all of its 1,000 North Sea staff and contractor roles will be up for review, with Petrofac and Altrad being the firm’s biggest employers.

Subsequent to the plan to cut jobs, the Spanish-owned firm announced plans to merge its North Sea assets with a privately-owned operator NEO Energy. This was the third such major merger deal in the basin after Shell and Eqinor and Ithaca and Eni did so.

© Ryan Duff/DCT Media

© Ryan Duff/DCT MediaBoland continued: “Repsol are in the process of making over 100 Petrofac employees redundant.”

According to the union man, a number of the triple digit jobs that are set to be lost will come from maintenance work.

Currently, the north-east of Scotland’s two largest service providers, Petrofac and Wood, are unable to trade shares as they find themselves in financial hot water.

However, recent contract wins across the two firms have led to some positivity about their future; whether this optimism is warranted is yet to be seen.

Dwindling upkeep of North Sea assets is also raising safety concerns around North Sea operations that the union is also keeping an eye on, Boland explained.

‘All operators are looking to reduce their numbers’

This is not just a few companies looking to slash headcount in a troubling time for industry.

“I would say all operators are looking to reduce their numbers, some more so than others,” Boland argued.

Two years ago, TAQA announced that it would vacate the UK by 2027, a move that will no doubt create further large-scale job losses.

The Unite regional officer said: “If you look at the TAQA situation, over the period of two years decommissioning, there will be the best part of 2,000 jobs plus jobs will go.”

He explained that when Unite counts job losses it uses “actual positions because sometimes there are people get redeployed to other jobs.”

However, “the problem is we’re seeing this number accelerating,” he added.

Boland explained that in a recent conversation with Harbour Energy he was told that “government policy changes, it won’t be the last” time job cuts will be announced in the UK.

“That starts dominoes falling and you start getting other operators saying, ‘well okay, maybe it’s time for us to move as well’,” he continued.

With mergers becoming more common for North Sea players, Boland is also concerned about onshore positions being slashed.

“Offshore, initially there probably won’t be any job losses because you still need the same amount of people to run the assets,” he said.

“But if you’ve got two onshore offices and logistic teams and HR teams and that, and you’re going into one building, it’s fairly obvious that is probably going to be the first place that’s going to get hit in numbers.”

Onshore jobs more likely to be axed than offshore positions

© Supplied by Wullie Marr/ DC Thom

© Supplied by Wullie Marr/ DC ThomThis is something that Unite has “seen before” as in 2023 Harbour Energy slashed 350 onshore positions as it blamed the UK’s windfall tax.

However, industry commentators argued that the firm was too bloated following its formation, which came from the 2020 reverse takeover of Premier Oil by Chrysaor.

“To a certain extent, it’s easy easier to cut onshore numbers than it is offshore numbers,” Boland said.

“You cut offshore numbers too much, then you stop production and they need that for the money to come in.

“You cut back on the onshore numbers, what you’re more likely to stop is for the tenders going in, new developments, new works, getting done, the design areas, project areas, these sort of areas.”

As a result, less work is handed out to tier one contractors which has an impact on the UK’s smaller suppliers as well as less work is up for grabs.

Unions siding with oil companies?

So, with the state of the industry leading to reduced spending and job cuts, will the Labour government change tack?

Boland answered: “Honestly no. I would love to say yes, it will change the position.”

Pointing to a recent consultation held by the Department of Energy Security and Net Zero (DESNZ) around the future of oil and gas licencing in the North Sea, Boland said it “will be interesting” to see the results.

There is another review being led by the Treasury, which closes end of May.

However, “in my view, and I think and view others as well, the consultations were a bit skewed towards the answers that they wanted,” he added.

© Supplied by Roddie Reid/DCT

© Supplied by Roddie Reid/DCT“But we put in very clearly what we think, and I know others have put in and I think they’ve had over 300 responses to the consultations.”

On the outcome of the consultations, Boland sees two potential outcomes for the UK’s oil and gas industry.

“They’re either going to listen and change tack, or they’re going to go against what everybody is actually saying, and they’ll prematurely bring an end to the North Sea, that’s the way I see it anyway.”

Supporting major oil and gas players and standing against a Labour government is something that the union man is finding uneasy.

Fighting for tax breaks for large companies is not usually the side trades unions find themselves on.

He admitted it’s an “unusual situation” unions find themselves in “where we’re agreeing with the employer more than we’re agreeing with a Labour government.”

© Image: BIG Partnership

© Image: BIG PartnershipHowever, as windfall profits have dissipated, Unite wants North Sea operators to continue investing in the UK to maintain its member’s jobs.

“When there were massive profits for oil and gas companies, yeah I totally agree with having some kind of extra taxation,” he said.

“But, when the profits are dropping and when the prices start dropping, you’ve got to have some bits in balance and ultimately, if the companies go out of business, then our members are out of work.

“So, I’ll make it very clear, we’re not looking for them to make lots of profits, but we need them there for actually keep people employed.”

The power of public opinion

© Jeff Moore/PA Wire

© Jeff Moore/PA WireHowever, the court of public opinion is something that industry, unions, and the communities impacted by job cuts can use in their favour, the Boland argued.

Labour campaigned on an anti-oil and gas manifesto in the build-up to the 2024 general election, and it has stuck with its hostile approach to North Sea operations since coming into office.

If this policy were to be looked at less favourably by voters, changes are sure to be made, Boland said.

“One thing I do know about politicians is they’re always very cautious about public opinion and if public opinion starts moving a