In a statement sent to Rigzone by UK union Unite on Thursday, the union announced that more than half of the members of Scottish parliament (MSP) have backed Unite’s North Sea oil and gas No Ban Without a Plan campaign.

The statement outlined that 30 Conservative MSPs, 27 Scottish National Party (SNP) MSPs, seven Labour MSPs, and one Alba Party MSP are supporting the campaign. There are 129 Members of the Scottish Parliament, comprising 62 SNP MSPs, 31 Scottish Conservative and Unionist Party MSPs, 22 Scottish Labour MSPs, seven Scottish Green Party MSPs, four Scottish Liberal Democrat MSPs, one Alba Party MSP, one Independent MSP, and one MSP with no party affiliation, the Scottish parliament website shows.

Unite noted in the statement that it is disappointed that no Green and no Liberal Democrat MSP has supported the campaign. It added that the Liberal Democrats “represent parts of Scotland including Orkney and Shetland”, which the union said “are heavily dependent on the oil and gas industry”.

“The majority of MSPs are clear that Labour needs to reverse its irresponsible policy banning all new oil and gas licenses irrespective of the impact on jobs,” Unite General Secretary Sharon Graham said in the statement.

“It is madness to do this without a viable plan including concrete equivalent jobs for North Sea workers and real assurances on energy security. We must not let go of one lifeline until we’ve got hold of another,” he added.

“Unite won’t sit back and let workers be abandoned – there must be a workers’ transition to net zero,” he went on to state.

Unite Scottish secretary Derek Thomson said in the statement, “oil and gas is essential to the economic success of Scotland”.

“It is outrageous that any government could countenance running down this sector until alternative options are in place,” he added.

“The UK government needs to sit up and listen. Oil and gas workers don’t need promises of jam tomorrow, they need alternative well paid skilled jobs now,” Thomson continued.

Rigzone contacted the UK Department of Energy Security and Net Zero (DESNZ), the SNP, the Scottish Conservative Party, the Scottish Labour party, the Scottish Green Party, the Scottish Liberal Democrat Party, and the Alba Party for comment on the Unite statement.

In response, Scottish Conservative shadow secretary for net zero and energy Douglas Lumsden told Rigzone, “the Labour government’s reckless decision to block all new oil and gas licences is economically and environmentally illiterate because it will devastate communities across the North East, damage the UK’s energy security, and increase our carbon footprint by forcing us to import fossil fuels from overseas”.

Scottish Liberal Democrat Liam McArthur, MSP for Orkney Islands, said, “no one can seriously doubt the time and effort my party has put into supporting the energy industry in the Northern Isles and elsewhere”.

“These are serious issues and we have been clear that we are fully committed to ensuring a just transition for oil and gas workers that harnesses their enormous skills and expertise,” he added.

“I meet regularly with those involved in the sector to discuss issues, including the support needed to allow a successful transition to take place,” he continued.

Maggie Chapman MSP, of the Scottish Green Party, told Rigzone, “we need a plan for a genuinely just transition that has workers and communities at its heart”.

“Trade unions must be central to that process. What is being done now is neither just nor a transition, and all too often it is being done to workers rather than having them at the center of it,” Chapman added.

“Continued oil and gas exploration is capital intensive, and we are concerned [it] will crowd out the investment we need to see in jobs for the future, preventing us from spending that money on the adaptation and mitigation measures we need to be implementing now,” Chapman continued.

“We must not delay the transition any further,” Chapman went on to state.

ALBA party leader Kenny MacAskill told Rigzone, “the support is welcome and long overdue – now it needs [to be] backed by the Scottish and UK governments”.

“It has to be invest, extend, and transition. To complete the journey, we need a plan and a just transition. We need to retain skills and continue to use our own resource, not import,” he added.

A spokesperson for DESNZ, which Rigzone also contacted for comment on Lumsden’s, MacAskill’s, and Chapman’s statements, told Rigzone, “the best way to secure Scotland’s energy economy is to invest in the clean power transition”.

“That is why it is at the forefront of our drive towards net zero and clean energy, with Great British Energy’s headquarters to be located in Aberdeen,” the spokesperson added.

“We’re making GBP 21.7 billion ($26.5 billion) available for carbon capture to support jobs, deliver clean power, and accelerate the UK towards net zero. This is the first step to a self-sustaining market and it is our firm ambition to proceed with projects in the Track-2 clusters. We are also supporting 11 green hydrogen projects across England, Scotland, and Wales,” the spokesperson continued.

“Our priority is a fair, orderly, and prosperous transition in the North Sea in line with our climate and legal obligations, and we will work with the sector to protect current and future generations of good jobs,” the spokesperson went on to state.

The Scottish Labour party directed Rigzone to DESNZ. The SNP has not yet responded to this Rigzone request at the time of writing.

Rigzone also approached SNP member Gillian Martin, the Scottish government’s acting cabinet secretary for net zero and energy, for comment on MacAskill’s statement and contacted industry body Offshore Energies UK (OEUK) for comment on Chapman’s statement.

In response, a Scottish government representative sent Rigzone a statement from Martin, which noted, “we are clear that any further extraction and use of fossil fuels must be consistent with Scotland’s climate obligations and just transition commitments”.

“It is vital that we take an evidence-based approach to the energy transition, which ensures that we support and retain the skills and investment needed for the transition to net zero,” the statement added.

“Decisions on North Sea oil and gas licensing are reserved to the UK government. We have consistently said that these should be made on a case-by-case basis and include rigorous assessments of both climate compatibility and energy security,” it continued.

“The judgements and issues in the draft energy strategy and just transition plan are being informed and influenced by recent developments in the UK government’s energy policy and court decisions. This is a rapidly changing landscape and we are taking time to reflect on those developments before drawing any final conclusions,” the statement went on to note.

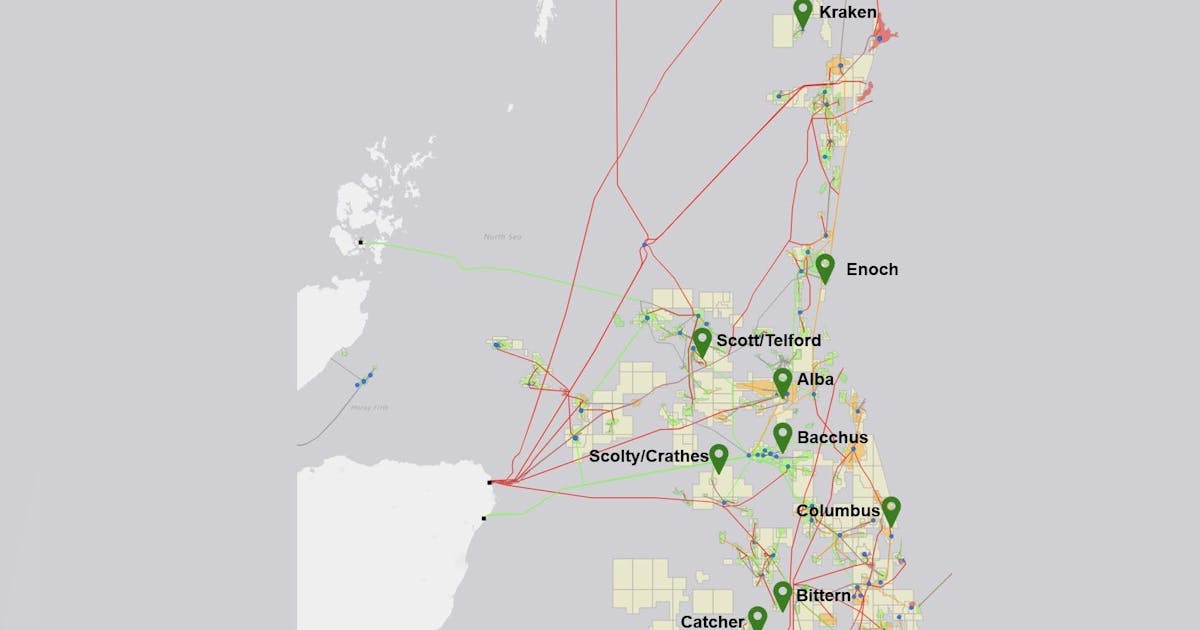

OEUK Sustainability and Policy Director Mike Tholen told Rigzone, “oil and gas is essential to the economic success of Scotland and there is still an abundance of oil and gas resources to develop offshore”.

“It’s important that politicians and policy makers understand that we should continue to make the most of these resources to support thousands of local jobs at the same time as providing homegrown energy for years to come,” he added.

“Building on current strengths allows us to accelerate the move into offshore wind and hydrogen production alongside carbon capture and storage,” he continued.

DESNZ’s website shows that the department’s priorities include “leading the government mission to achieve clean power by 2030 and accelerat[ing]… to net zero” and “establishing a just and orderly transition away from fossil fuels”.

“A fair and prosperous transition in the North Sea – consistent with our position on no new oil and gas licenses and our commitment to accelerating the deployment of offshore wind, CCUS, and hydrogen,” a priorities list on DESNZ’s site notes.

A release posted on DESNZ’s website back in August stated that “oil and gas production in the North Sea will be a key component of the UK energy landscape for decades to come as it transitions to our clean energy future in a way that protects jobs”.

“The government believes that offshore workers will lead the world in the industries of the future,” the release added.

A UK general election took place on July 4, which Labour won. The party has a current working majority of 163, the UK parliament website shows.

To contact the author, email [email protected]