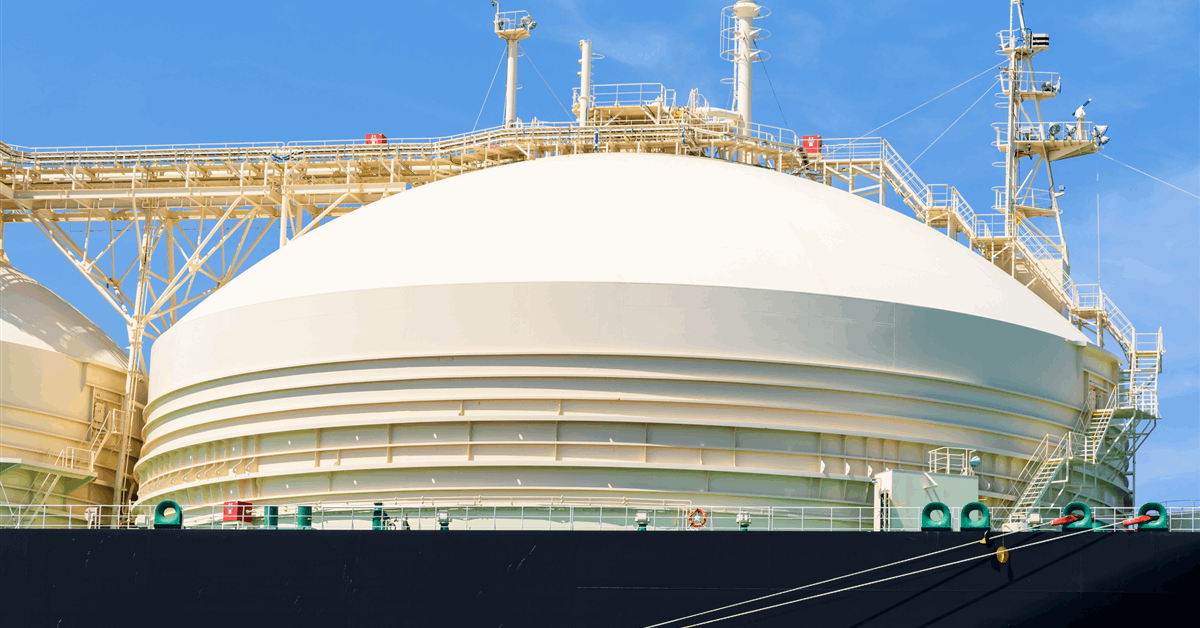

The U.S. has emerged as the world’s hydrocarbon superpower, exemplified by its meteoric rise in the liquefied natural gas (LNG) market.

That’s what Wood Mackenzie (WoodMac) said in a statement sent to Rigzone recently, which highlighted several charts that “spotlight the most significant trends reshaping the [energy and resources] sector globally” and were included in the company’s latest Horizons report.

“You don’t need to look too far back to find a U.S. which was building LNG import infrastructure and now in under 10 years it has become the world’s largest LNG exporter,” WoodMac said in the statement.

The company noted in the statement that, by 2030, the U.S. is projected to account for 30 percent of global LNG output. A chart included in the statement outlined that the U.S. would continue as the world’s largest LNG exporter in 2030, followed by Qatar and Australia.

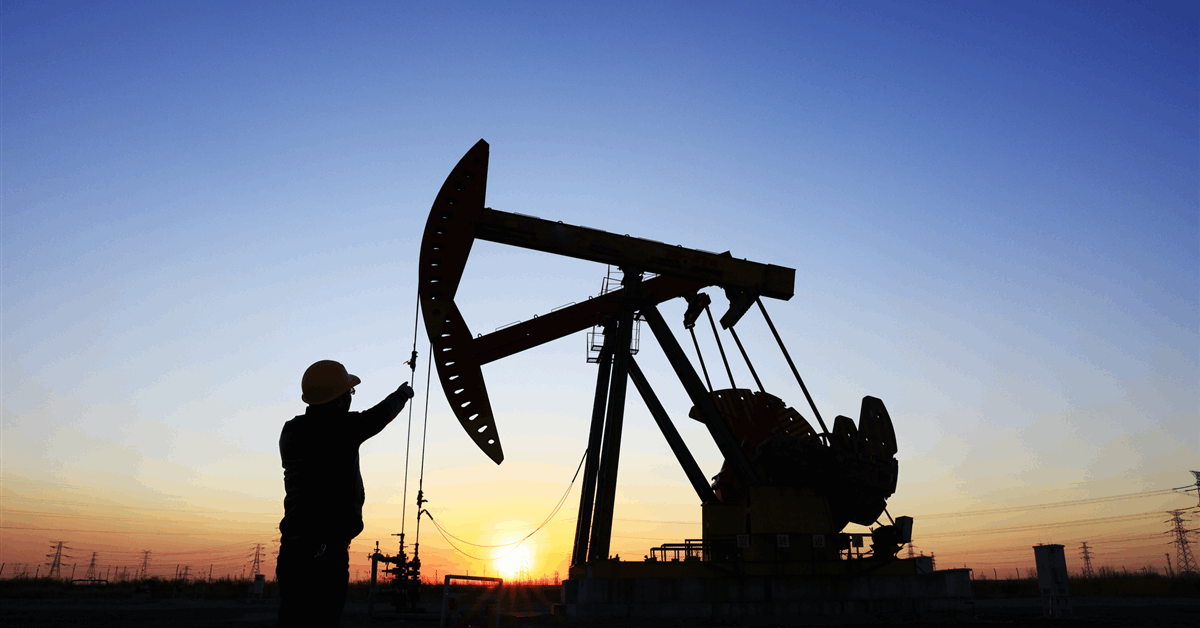

WoodMac also highlighted in its statement that the U.S. “leads global oil production (including oil, condensate, and natural gas liquids), delivering one-fifth of the world’s volumes”.

“In comparison, its closest competitors, Saudi Arabia and Russia, produce only 65 percent and 50 percent of U.S. volumes, respectively,” it added.

Malcolm Forbes-Cable, Vice President, Upstream and Carbon Management Consulting at Wood Mackenzie, said in the statement, “the resurrection of U.S. LNG is a crucial reminder of what a resource-rich, free-market country like the U.S. can do”.

“This hydrocarbon hegemony is now being leveraged as a diplomatic tool,” he added.

In its latest short term energy outlook (STEO), which was released on December 9, the U.S. Energy Information Administration (EIA) projected that gross U.S. LNG exports will average 14.9 billion cubic feet per day in 2025 and 16.3 billion cubic feet per day in 2026. Gross U.S. LNG exports averaged 11.9 billion cubic feet per day in 2024, this STEO highlighted.

A quarterly breakdown included in the EIA’s latest STEO forecasted that gross U.S. LNG exports will come in at 16.7 billion cubic feet per day in the fourth quarter of this year, 16.5 billion cubic feet per day in the first quarter of 2026, 16.0 billion cubic feet per day in the second quarter, 15.3 billion cubic feet per day in the third quarter, and 17.7 billion cubic feet per day in the fourth quarter.

The EIA’s latest STEO also projected that total U.S. crude oil production, including lease condensate, will average 13.61 million barrels per day in 2025 and 13.53 million barrels per day in 2026. In 2024, this output averaged 13.23 million barrels per day, the EIA’s December STEO showed.

Another quarterly breakdown included in the EIA’s December STEO forecasted that U.S. crude oil production will average 13.86 million barrels per day in the fourth quarter of this year, 13.63 million barrels per day in the first quarter of next year, 13.58 million barrels per day in the second quarter, 13.44 million barrels per day in the third quarter, and 13.49 million barrels per day in the fourth quarter of 2026.

According to the Energy Institute’s (EI) latest statistical review of world energy, which was released earlier this year, the U.S. was the world’s largest natural gas producer last year with 37.19 exajoules. This figure marked 25.0 percent of the global total, the review highlighted.

The U.S. was also the world’s largest oil producer, with 20.135 million barrels per day, and crude oil and condensate producer, with 13.194 million barrels per day, in 2024, the EI review showed. The former represented 20.8 percent of global oil production and the latter represented 15.9 percent of global crude oil and condensate production in 2024, the review highlighted.

The EI report points out that its natural gas figures exclude gas flared or recycled and include natural gas produced for gas-to-liquids transformation. It also highlights that its oil production figures include crude oil, shale oil, oil sands, condensates (lease condensate or gas condensates that require further refining), and NGLs (natural gas liquids – ethane, LPG and naphtha separated from the production of natural gas). They exclude liquid fuels from other sources such as biofuels and synthetic derivatives of coal and natural gas and also exclude liquid fuel adjustment factors such as refinery processing gain, as well as oil shales/kerogen extracted in solid form, the review outlined.

In its review, the EI also points out that its crude oil and condensate production figures include crude oil, shale/tight oil, oil sands, and lease condensate or gas condensates that require further refining. They exclude liquid fuels from other sources such as biomass and synthetic derivatives of coal and natural gas, the review outlines.

WoodMac’s Horizons report explores “the themes shaping the energy and natural resources landscape, bringing you crucial insights, new perspectives, bold forecasts and food for thought”, the company’s website notes.

The EI states in its review that it is the professional membership body for the world of energy. It adds in its publication that the statistical review of world energy analyzes data on world energy markets from the prior year and notes that the review “has been providing timely, comprehensive, and objective data to the energy community since 1952”.

To contact the author, email [email protected]