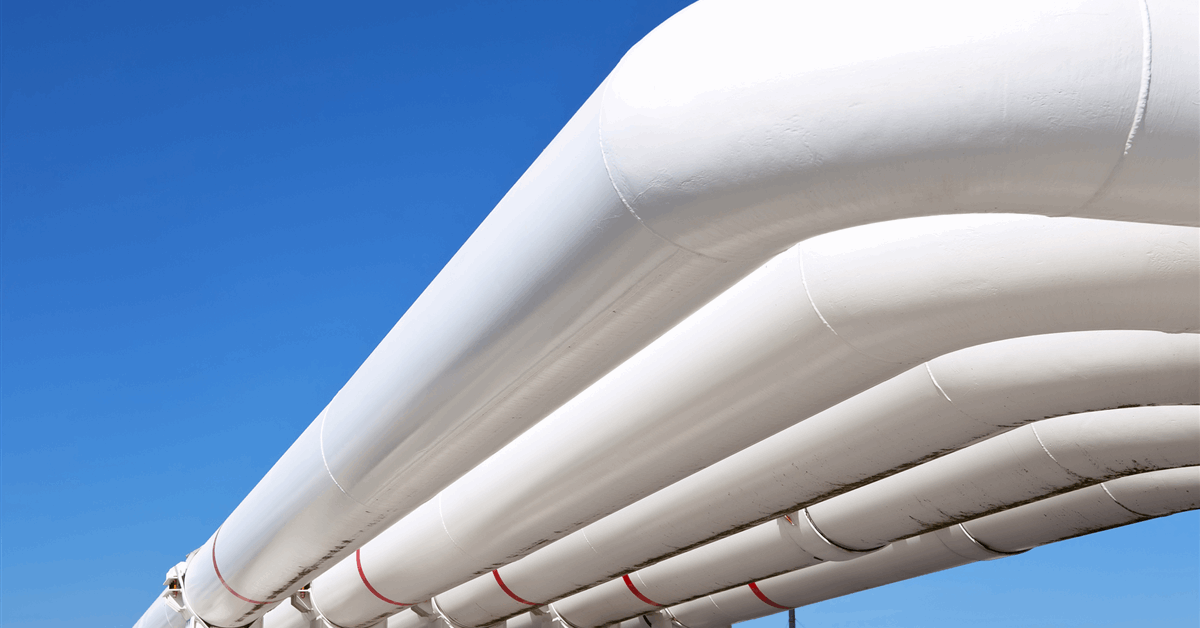

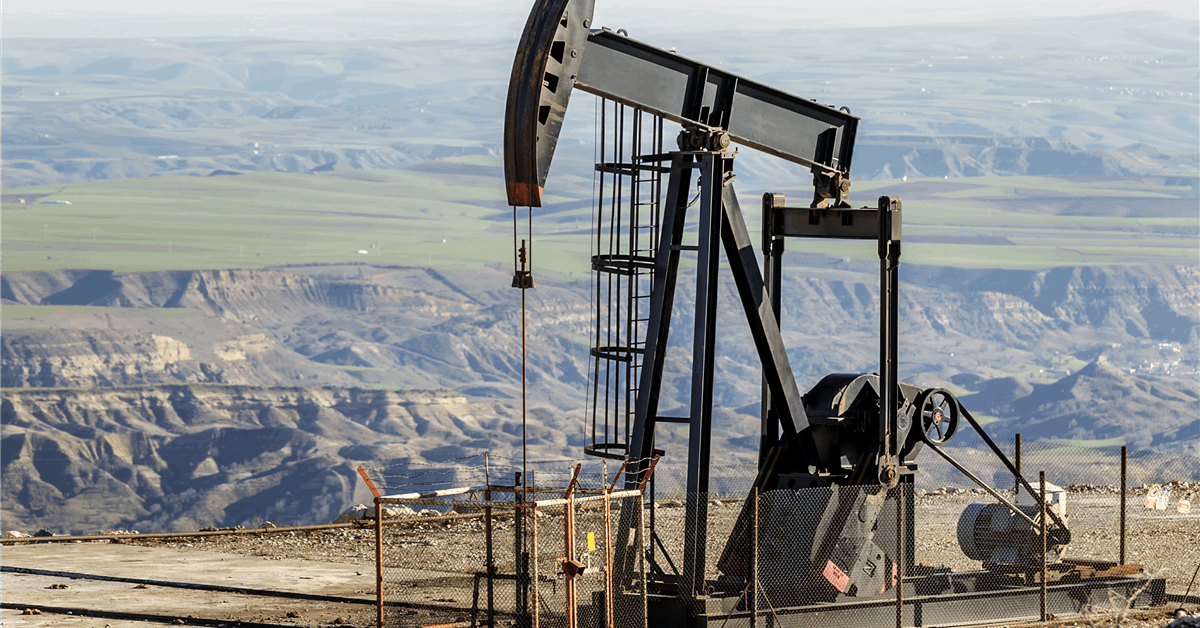

In a statement sent to Rigzone this week, U.S. Energy Development Corporation (USEDC) announced “plans to deploy up to $1 billion during 2025, primarily in the Permian Basin”.

USEDC said in the statement that its announcement follows a record-breaking year during which USEDC deployed nearly $800 million into operated and non-operated projects. Last year, USEDC evaluated over 220 opportunities and completed 29 transactions, the company highlighted in the statement, pointing out that these were both increases from 2023 totals.

USEDC also noted in the statement that the company improved cost efficiency, “seeing reductions in cost per lateral foot while maintaining strong productivity”. In 2023, USEDC closed 19 transactions and deployed nearly $600 million, the company said in the statement. It highlighted that most of these were in the Permian Basin, “with other projects in the Barnett, Haynesville, and Powder River basins”.

“Building on the momentum of 2024, USEDC is entering 2025 with a similar growth mindset, aiming to invest up to $1 billion in U.S.-operated and non-operated oil and gas projects, primarily in the Permian Basin,” USEDC said in the statement.

Rigzone asked the company if this $1 billion investment will result in any additional jobs or job retention. Responding to the question, a USEDC spokesperson said, “yes, we expect our anticipated capital deployment aims for 2025 to facilitate further opportunities to grow and strengthen our team”.

In the statement sent to Rigzone this week, USEDC said it expects the Permian Basin to remain the primary focus of its investment in 2025 due largely to the economics of drilling and operating wells in the basin. The company said in the statement that it has experienced consistent results and is confident in its ability to continue to acquire high-potential Permian Basin properties and efficiently manage the costs of operated and non-operated ventures.

“We have built a strong track record of sourcing and transacting on high-quality opportunities, and our ability to deploy capital efficiently continues to drive strong results,” Jordan Jayson, Chairman and CEO of USEDC.

“Our approach remains the same – we will continue to evaluate opportunities that align with our disciplined investment strategy and deliver value to our partners. With a strong foundation and a targeted approach, we are well-positioned to build on our momentum entering 2025,” he added.

“Our long-term acquisition and production strategies continue to generate solid performance across a portfolio of more than 2,000 wells. Despite global price volatility and market uncertainty, the energy market remained relatively stable, and our reputation for completing deals resulted in a record flow of successful transactions and capital deployment in 2024,” Jayson went on to state.

In a statement posted on its site in December last year, USEDC Executive Vice President Matthew Iak said, “despite the geopolitical uncertainty in the U.S. and the rest of the world in 2024, the energy markets have remained relatively stable, and deal flow has been strong”.

“It is almost paradoxical that during a tumultuous year, globally and domestically, the energy market’s remarkable achievement has been its truly unremarkable stability,” he added.

“For USEDC, we continued to see a steady, attractive deal flow, many at advantageous price levels for companies with a solid capital structure and robust infrastructure,” he went on to state.

“We continue to actively pursue and invest in deals within the Permian Basin, recognizing it as one of the best areas for predictable productivity and returns,” he continued.

In another statement posted on its site in June last year, USEDC said it was “strategically expanding its operations in the prolific Permian Basin”.

“Building on a series of recent successes, the company is poised for significant growth and development in one of the most productive oil and gas regions in the United States,” the company added in that statement.

USEDC describes itself as a privately held exploration and production firm that manages assets for itself and its partners. The company is headquartered in the Dallas-Fort Worth metro area and has invested in, operated, and/or drilled approximately 4,000 wells in 13 states and Canada and deployed more than $2 billion on behalf of itself and its partners, according to its website.

To contact the author, email [email protected]