Utility use of innovations to manage challenges like load growth and affordability can be streamlined with smarter pilot project designs, new U.S. Department of Energy research found.

Today’s pilots are often redundant, inconclusive and lack clear pathways to scale, a June Lawrence Berkeley National Laboratory report on pilot project designs concluded.

“With safety as a top utility priority, utilities are hesitant” about new technologies or methods, but “it is critical that utilities are able to quickly test good ideas,” the LBNL report said.

Some utilities have started to move quickly, faced with the pressure of rising demand, especially from data centers, which threatens to outpace new generation and storage additions.

Salt River Project’s May 3 demonstration of data center load flexibility using Emerald AI software has already led to an announced scale deployment in the PJM Interconnection system. Many utilities are pursuing ways to achieve this type of speed-to-innovation.

“It is more imperative now to take innovative projects and pilots to scale quickly because customer adoption, expectations, and technology are evolving at an exponential pace,” said Chanel Parson, Southern California Edison’s director of clean energy and demand response.

The faster utilities scale solutions, “the faster they can keep up,” she added.

Utilities are working with their regulators to find pilot project designs that speed innovation, the LBNL study found.

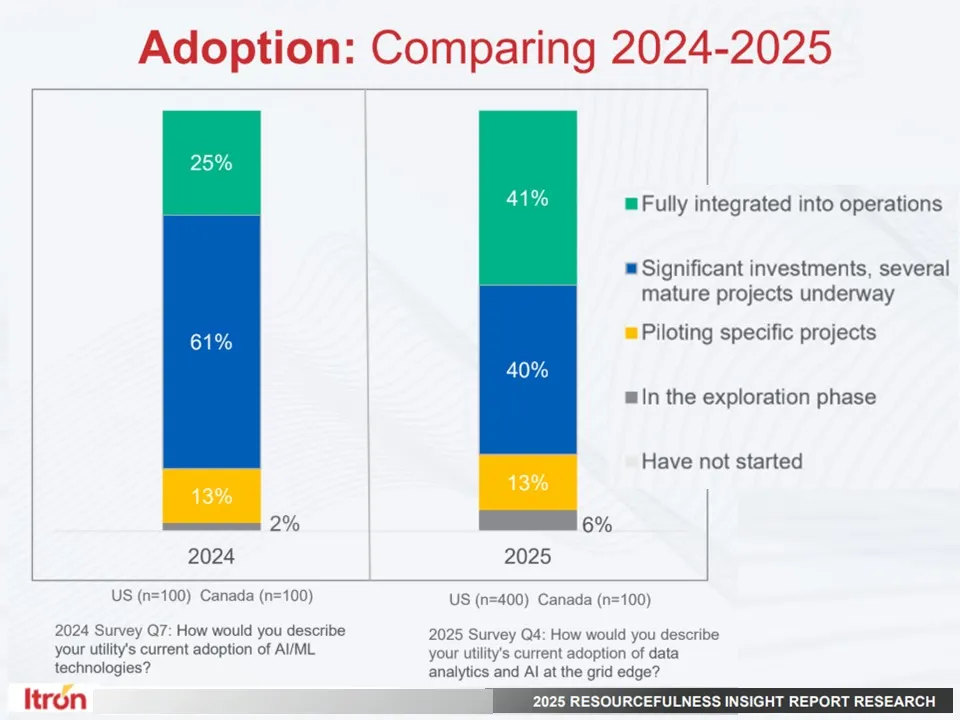

To meet its quickly growing electric vehicle penetration, Pacific Gas and Electric’s managed charging program for 1,000 customers, launched in January, is already nearing its next phase, said Marina Donovan, vice president of global marketing for smart meter provider Itron.

“That shows the speed the utility wants to move at,” she said.

Streamlined pilot design frameworks, often called “regulatory sandboxes,” can support speed-to-innovation, LBNL’s study reported. They have validated new value propositions and implementation, operational, planning and investment approaches.

Barriers include financial, regulatory disincentives

Pilots are key to innovation, but utilities tend to under-invest in new technologies and methods compared to more innovative industries, according to a different LBNL analysis from 2022.

Some utilities have seen success with scaling pilots gradually.

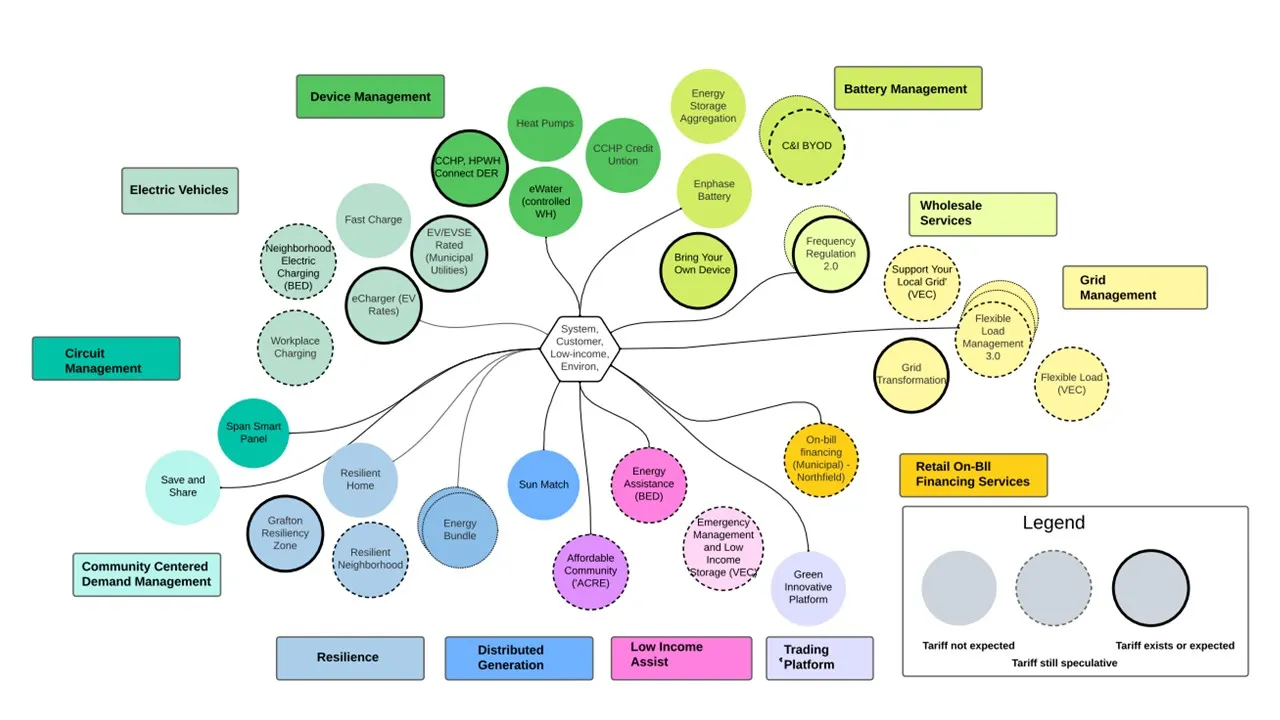

Green Mountain Power pilots “laid the foundation to where we are now,” said Kristin Carlson, a spokesperson for the Vermont-based investor-owned utility.

During a June 2025 peak, Green Mountain Power’s distributed energy storage virtual power plant program saved customers “about $3 million in one hour,” she added.

But, like most traditional pilots, the utility’s VPP program grew slowly. It began with 20 customers in 2017 and now has 5,035 participants providing over 75 MW of dispatchable peaking resources, Carlson said.

Southern California Edison has also nurtured its VPP innovation over time, according to utility spokesperson Jeff Monford. Its 5-MW Power Flex solar-plus-storage VPP pilot, launched with Sunrun in 2020, now has multiple vendors and a capacity of 25 MW, with plans to continue growing beyond 2027, Monford said.

The utility financial disincentive is a key barrier to accelerating innovative utility pilot programs, the LBNL analysis found.

To obtain approval for recovery of investment costs, utilities must show regulators their proposed technologies will benefit customers, LBNL’s analysts said. That discourages utility investments in pilots of unproven tools and methods, and favors “the status quo that has historically offered them a stable business environment,” they added.

Also, traditional pilot frameworks often do not clarify specific pilot parameters, the analysts said. That leads to misleading metrics, biased or inconclusive results, redundancies, disputes between participants, delays in approval and implementation and, critically, pilots without clear pathways to scaling, they added.

But these challenges can be overcome with better policy, said Anne Hoskins, a Generac Power Systems executive and former commissioner with the Maryland Public Service Commission.

For example, she said, a pilot framework could include cost limits, timelines, requirements for sharing lessons learned and clear next steps for completed projects.

“Regulators can create frameworks for a ‘sandbox’ to fast-track approval of innovative pilot programs that stay within guidelines,” she said. This can be a low-cost way to test new technologies, tools, or methods, she added.

Optional Caption

Permission granted by Itron

Piloting large load flexibility

One key innovation to come out of recent pilots is data center flexibility. While the concept is still fairly new, it has already been taken up by Energy Secretary Chris Wright, who called on federal regulators to streamline approval of interconnections for flexible data centers.

One key public demonstration of data center flexibility potential came in the May collaboration of Salt River Project with participants in the Electric Power Research Institute’s DCFlex initiative.

The first of a planned series, it showed data center flexibility is achievable without compromising the value proposition of data centers willing to participate, said EPRI Emerging Technologies Executive Anuja Ratnayake.

Unlike the rigorous and repeatable pilot processes described by LBNL, the Arizona demonstration with Emerald AI software was “one specific controlled test,” Ratnayake said. It had predetermined conditions in a planned four-step process that will, by mid-2026, test the software in real-time operations, she added.

Emerald AI’s fourth demonstration, scheduled for mid-2026 at the 96-MW Aurora AI Factory on the PJM system in Virginia, will be under full-scale, real time, real world conditions, Ratnayake said. It will show how much flexibility the software can deliver at scale.

AI companies’ are impatient because the speed of data center interconnections will determine how soon artificial general intelligence is developed, said Emerald AI CEO Varun Sivaram.

But certainty of data center flexibility must be demonstrated before system operators will accept it as the solution for more rapid interconnection of large loads, according to a November PJM market monitor report that questioned flexibility as a feasible solution for the country’s largest grid operator.

Emerald AI’s streamlined four-demonstration process, with escalating challenges, is intended to give utilities the confidence to connect flexible data centers faster, Sivaram said.

He expressed confidence that once flexibility can be successfully demonstrated at scale, “the floodgates will open for this understandably cautious, careful industry to move faster.”

Optional Caption

Permission granted by Commissioner Riley Allen

‘I want to see utilities use our sandbox’

State regulators and regulated utilities are also working, with mixed success, on ways to make speed-to-innovation through pilots a reality. Innovation can come faster if policymakers set clear goals and remove regulatory barriers to smarter pilot designs, researchers and stakeholders said.

Policy directives and vision statements can identify a goal “that stakeholders can rally around and drive towards,” LBNL said in its report.

It pointed to examples set by New Jersey’s Energy Master Plan, Hawaii’s 2014 Inclinations on the Future of Hawaii’s Electric Utilities and its 2024 follow-up, and the District of Columbia’s PowerPath DC, all of which drove “ambitious energy objectives.”

To further advance the pace of innovation, the Hawaii commission’s 2020 Innovative Pilot Framework streamlined pilot implementation, LBNL said. Specifically, it limited regulatory review to 45 days and reduced cost recovery uncertainty, it added.

In 2019, with Green Mountain Power’s distributed energy storage program growing, the Vermont Public Utility Commission ordered a multi-year regulation plan with an innovative pilot program framework that has allowed the utility to scale multiple pilots.

VPUC Commissioner Riley Allen said two important features of that plan were that it required early notice to stakeholders and guardrails limiting cost increases to 2%.

“Utilities are reluctant to move off known frameworks, but the industry needs to be responsive to emerging factors like growing electricity demand,” Allen said. The sandbox concept “creates the space to do good things within the regulatory process.”

Michigan’s 2019 Power Grid initiative included an expedited 90-day pilot approval process and incentives for utility-stakeholder collaborations, LBNL said. But under its guidelines, according to Michigan’s pilot database, pilots “have not progressed to full-scale programs,” the researchers added.

Progress continues to come through slower general rate cases, said Michigan Public Service Commissioner Katherine Peretick.

“I want to see utilities use our sandbox,” she said, adding that “the growing electricity demand may create more utility interest in taking advantage of its expedited pilot framework.”

Two other models — New York’s Reforming the Energy Vision and Oregon’s Smart Grid Testbed programs — also represent important efforts at sandbox frameworks, LBNL said.

Randomized Control Trials, or RCTs, are an outside-the-sandbox speed-to-innovation approach championed by customer-owned device aggregator Renew Home. Data from RCTs can approximate the value customers’ smart devices deliver, by-passing the pilot process completely, Renew Home CEO Ben Brown said.

Optional Caption

Permission granted by Clean Energy Group

The Connecticut model

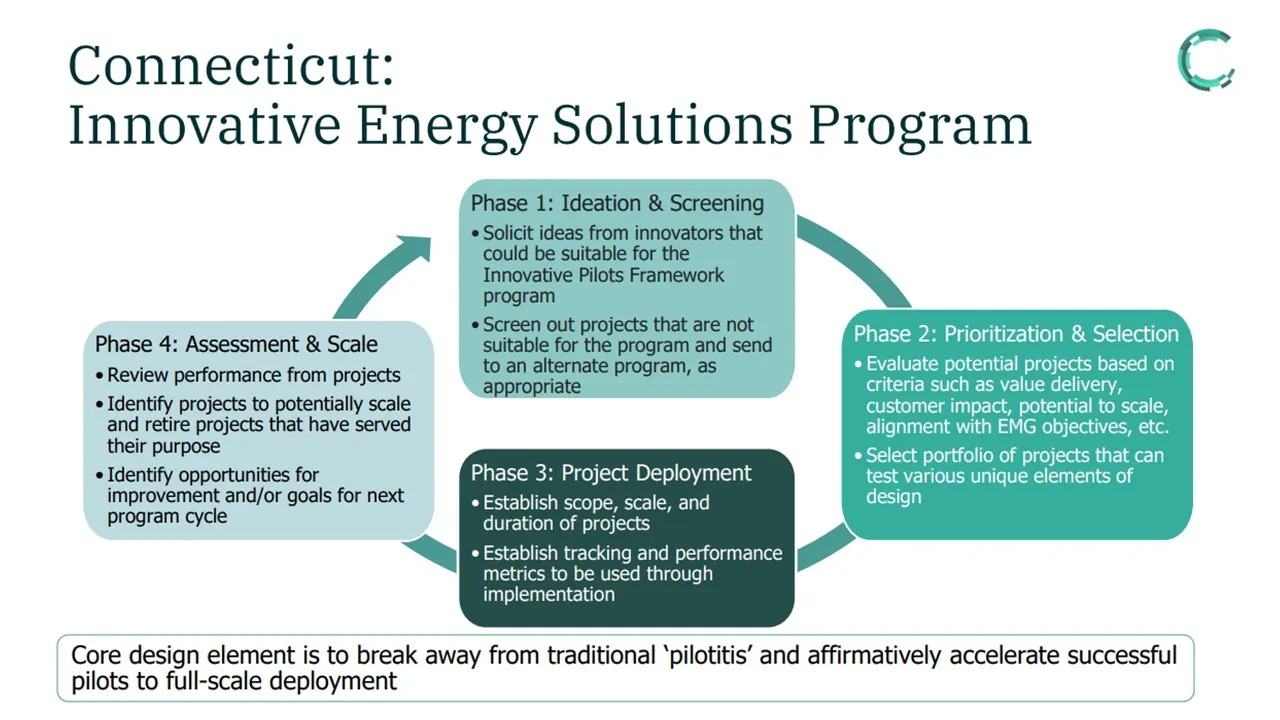

Connecticut’s Innovative Energy Solutions, or IES, sandbox framework is attracting attention as a potential model to follow as it prepares to evaluate its completed first cycle of pilots.

In 2023, the Connecticut Public Utilities Regulatory Authority, or PURA, launched the first cycle of pilots, with new cycles to follow annually, LBNL said. The framework requires four phases, with proposals followed by selection, then deployment, and, finally, evaluation, the researchers added.

To reduce deployment barriers and facilitate collaboration, the IES allows pilots led by vendors, utilities or utility-vendor collaborations, LBNL’s paper said.

The IES was designed to get over the regulatory barriers and provide regulatory certainty that the pilot process would “lead to something,” said former PURA Chair Marissa Paslick Gillett, who oversaw that design. It also provides “a regulatory environment for innovation,” she added.

“A fail-fast mentality was built into the process with milestones that must be met to obtain continued funding,” Gillett said.

Scalability is not yet clearly defined, but Connecticut has legislation allowing PURA to compel a utility to scale a pilot project that has produced evidence of viability in a regulated process, she added.

“Regulatory sandboxes accelerate innovation within the existing regulatory framework and the IES program is one of the best examples,” said Matt McDonnell, a co-founding partner of regulatory consultant Current Energy Group and an independent administrator of Connecticut’s program.

IES reduces the typical pilot’s timeline from at least four years to two years, McDonnell said. And its three participation pathways all contain ratepayer protections, he added

Piclo’s grid flexibility marketplace recently completed the first IES cycle in collaboration with Eversource Energy and United Illuminating.

In their final reports, both utilities and Piclo agreed the market launched faster and attracted more flexibility providers than expected.

“But the most important part of building a marketplace is continuity,” said Piclo CEO James Johnston. “If there is a second year and a line of sight for five years of revenue opportunities, participants will grow.”

Connecticut utilities were not convinced, however. The Piclo pilot fell short on provider participation, location specificity, cost efficiencies and operations, Eversource Energy reported.

And because system infrastructure to visualize and control customer-owned resources is lacking, Piclo’s market is premature for Connecticut, both Eversource and United Illuminating concluded. PicIo’s solution might be workable “as market conditions and grid requirements evolve,” United Illuminating said.

But concerns with load growth, reliability and affordability make it important to get more out of the grid, former PURA Chair Gillett said.

“The IES framework gives PURA commissioners the final word on the pilots in its sandbox in only two years,” McDonnell said.

Its ruling on Piclo, and the other projects in each cycle, “will provide guidance for how this type of division between utility and vendor participants should be resolved,” he added.

The final report from the IES administrator is due Dec. 15. The commission has indicated it is committed to reaching a final ruling as soon as possible.