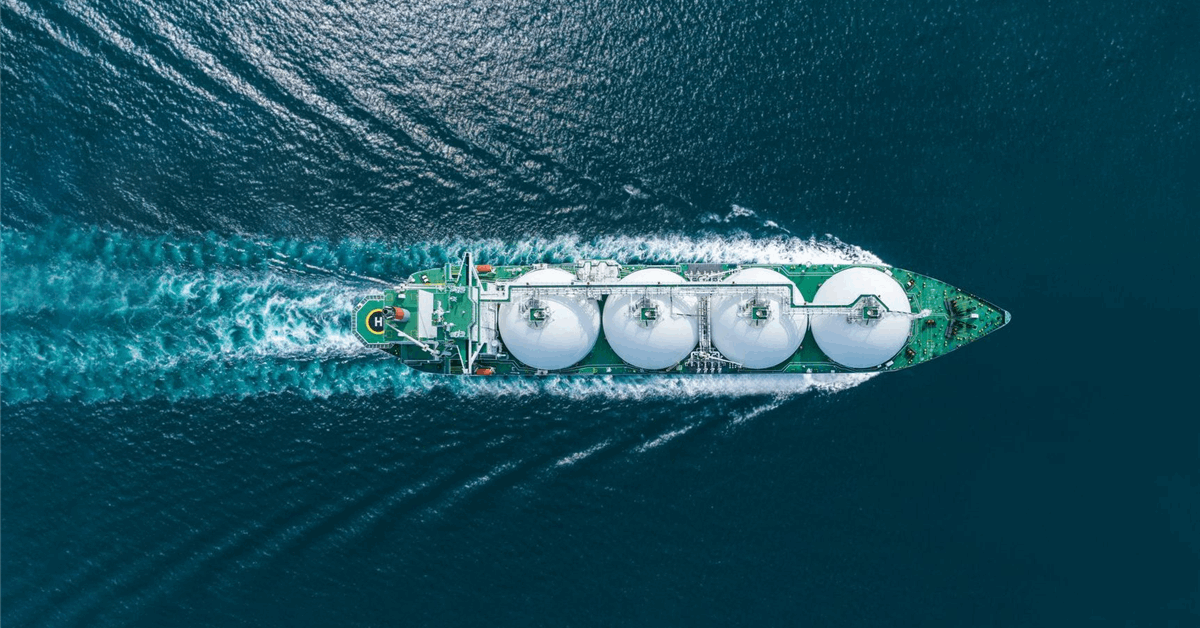

Woodside Energy Group Ltd. said Tuesday it had made a positive final investment decision (FID) on the Louisiana LNG project.

“The forecast total capital expenditure for the LNG project, pipeline and management reserve is US$17.5 billion (100 percent)”, the Australian oil and gas exploration and production company said in an online statement.

As part of a deal announced earlier this month, New York City-based Stonepeak Partners LP will provide a staggered contribution of $5.7 billion in exchange for a 40 percent stake.

Woodside later signed an agreement with Uniper SE to supply the German power and natural gas utility up to 1 MMtpa from Louisiana LNG for 13 years and up to 1 MMtpa from Woodside’s global portfolio from the start of Louisiana LNG’s operation through 2039.

The Gulf Coast project has an Energy Department permit to export a cumulative 1.42 trillion cubic feet a year of natural gas equivalent, or 27.6 million metric tons per annum (MMtpa) of liquefied natural gas (LNG) according to Woodside, to both FTA and non-FTA countries.

The FID announced Tuesday is for phase 1, which involves 3 liquefaction trains with a combined capacity of 16.5 MMtpa,

“Development of Louisiana LNG will position Woodside as a global LNG powerhouse, enabling the company to deliver approximately 24 Mtpa [million metric tons per annum] from its global LNG portfolio in the 2030s, and operating over 5 percent of global LNG supply”, Woodside said. “The development has expansion capacity for two additional LNG trains and is fully permitted for a total capacity of 27.6 Mtpa.

“Louisiana LNG represents a compelling investment that will deliver significant cash flow and create long-term value for Woodside shareholders. It exceeds Woodside’s capital allocation targets, delivering an internal rate of return above 13 percent and a payback period of seven years.

“At full capacity, the foundation project is expected to generate approximately $2 billion of annual net operating cash in the 2030s. It will drive Woodside’s next chapter of value creation, giving the company’s global portfolio the potential to generate over $8 billion of annual net operating cash in the 2030s”.

Woodside said it would not adjust its emission reduction plan to account for Louisiana LNG, which it acquired last year as part of a $1.2 billion takeover of Tellurian Inc.

Chief executive Meg O’Neill said, “Adding Louisiana LNG to our established Australian LNG business provides Woodside with a balanced and resilient portfolio, combining long-life, flexible LNG assets with high-return oil assets”.

“The project benefits from access to abundant low-cost gas resources in the United States and boasts an asset lifespan of more than 40 years”, O’Neill added. “It also has access to well-established interstate and intrastate gas supply networks.

“The marketing opportunities Louisiana LNG offers across the Pacific and Atlantic Basins leverage Woodside’s proven LNG marketing capabilities and complement our established position in Asia. This will position Woodside to even better serve global customers and meet growing energy demand.

“This supply can target strong and sustained demand for LNG expected in both Asia and Europe, as those markets pursue energy security and decarbonization aspirations.

“We are pleased with the strong level of interest from potential strategic partners and are advancing discussions targeting further equity sell-downs”.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR