The boards of Sintana Energy Inc and Challenger Energy Group PLC have agreed on the terms of Sintana’s acquisition of the entire issued and to-be-issued share capital of Challenger for an implied diluted price of around GBP 44.72 million/ CAD 83.63 million ($59.72 million) or 16.61 pence per share.

London-listed Challenger’s main assets are a 40 percent stake in Chevron Corp-operated AREA OFF-1 and a 100 percent ownership in AREA OFF-3, both exploration blocks offshore Uruguay.

“Combined, these represent a total license holding of approximately 27,800 square kilometers (net to Challenger approximately 19,000 sqkm), making Challenger one of the largest offshore acreage holders in Uruguay and the only ‘junior’ with a position in offshore Uruguay and the broader offshore region (including northern Argentina and southern Brazil)”, Sintana said in a statement on its website.

Challenger also holds legacy exploration assets in The Bahamas, for which the government has not responded to a request for license renewal, Sintana noted.

Sintana, whose stock trades in Toronto, owns onshore and offshore exploration licenses in Namibia and Colombia’s Magdalena Basin.

“The combination of Challenger and Sintana is expected to create a leading exploration platform spanning the Southern Atlantic conjugate margin, with a combined portfolio offering high-impact exposure to two of the world’s currently most active and emerging hydrocarbon exploration geographies with a diversified portfolio of licenses at various levels of maturity, underpinned by partnerships with majors that provide significant financial and operational support to reach material milestones”, the statement said.

The expanded Sintana would own interests in eight licenses in Namibia – including the Mopane discovery – and Uruguay, as well as legacy assets in The Bahamas and Colombia, Sintana said.

Under the transaction, Challenger shareholders would receive about 0.4705 common shares of Sintana for each Challenger ordinary share held. Immediately after the completion of the merger, Challenger shareholders would own approximately 25 percent of the issued share capital of Sintana, based on the volumes of Sintana and Challenger shares as of October 8.

“The terms of the acquisition represent a premium of approximately 44 percent to the closing price of 11.5 pence per Challenger share on October 8, 2025; 97 percent to the volume weighted average price of 8.41 pence per Challenger share for the three-month period ended on October 8, 2025; and 96 percent to the volume weighted average price of 8.48 pence per Challenger share for the six-month period ended on October 8, 2025”, Sintana said.

Charlestown, a shareholder in both Sintana and Challenger, agreed to a loan of $4 million for Sintana upon the completion of the merger, Sintana said.

“The independent directors of the board of Challenger intend to recommend unanimously that Challenger shareholders vote in favor of the acquisition and Sintana has received irrevocable undertakings from certain of Challenger’s shareholders (including directors) to vote their Challenger shares in favor of the acquisition representing, in aggregate, approximately 34.2 percent of Challenger’s issued ordinary share capital as of October 8, 2025”, Sintana said.

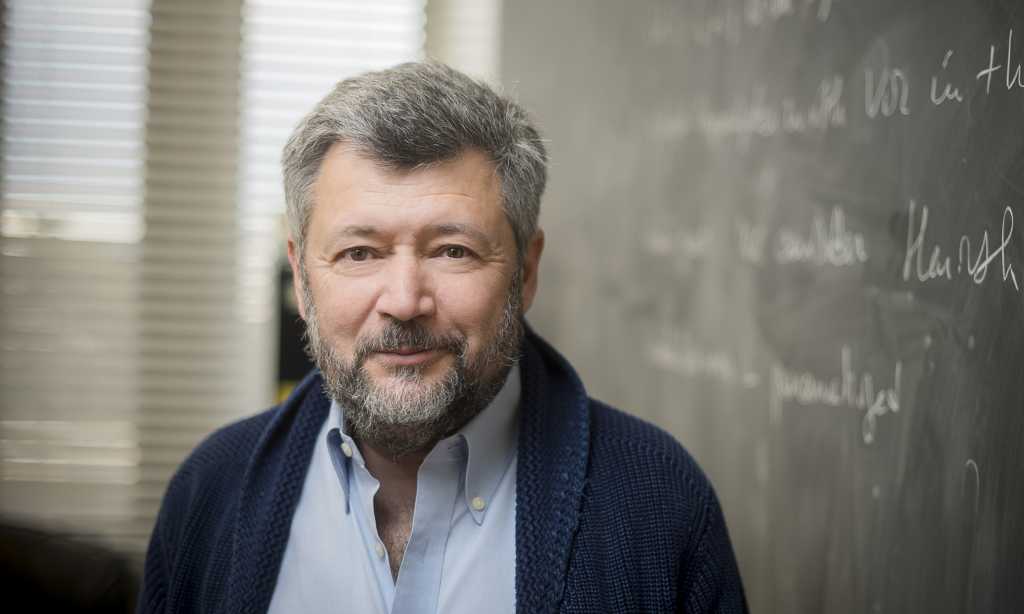

If the combination is consummated, Challenger chief executive Eytan Uliel will be Sintana president and executive director. Challenger non-executive chair Iain McKendrick will be appointed non-executive director at Sintana, Sintana said.

Sintana executive chair Keith Spickelmier will transition to being non-executive chair after the merger. Sintana president Doug Manner will become a non-executive director. Non-executive directors Bruno Maruzzo and Dean Gendron, as well as chief operating officer David Cherry, will leave Sintana.

The parties expect to close the transaction by year-end, subject to customary conditions, Sintana said.

“This recommended merger fulfils all the strategic intentions of Challenger, creating an entity with a diversified and very high-graded portfolio, and which will be a springboard to further excellent returns for both sets of shareholders”, McKendrick said in a statement.

To contact the author, email [email protected]