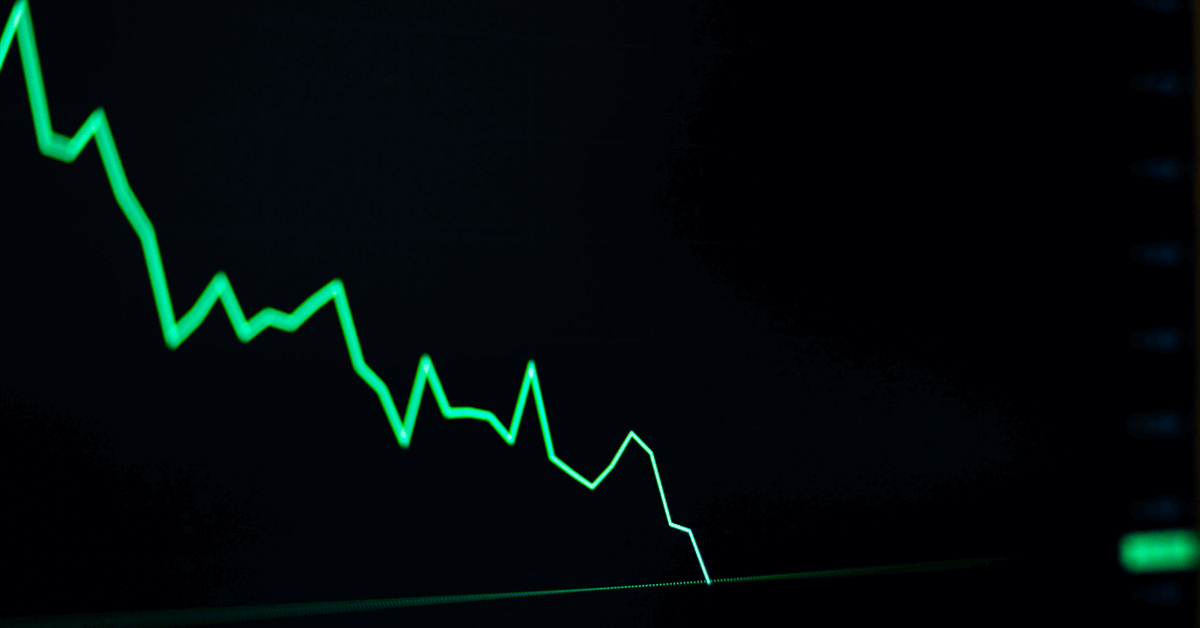

Finance is increasingly a weapon of war. United States policymakers and our allies focus too narrowly on macroeconomic tools like sanctions and promoting the dollar as a reserve currency when the modern front is evolving. Today, the real battles are being waged on smartphones and in the global currency markets.

China is waging a multi-decade plan to displace the United States’ greatest asset: the dollar. The dollar is critical to the United States’ economic and geopolitical power as the global reserve currency. Without it, our influence would weaken, and our debt would become a bigger problem. This is precisely what the Chinese Communist Party and the Kremlin want.

China and Russia have shed billions of dollars worth of U.S. Treasury holdings while growing their stockpiles of gold. Our sanctions, designed to separate countries from the “Western” economic system, are no longer enough of a deterrent for those who can control financial activity within their borders and project their power outward.

Authoritarian adversaries — including China, Iran and Russia — are actively building parallel cross-border economic systems that will pull into their orbits not only neighboring countries but also our allies who trade heavily with them.

For example, over half of businesses in Japan accept Alipay, while more than one-third accept WeChat Pay. This distribution gives two Chinese firms unprecedented visibility into the individual market transactions of Japanese consumers and businesses. It could allow China to disrupt Japan’s economy should tensions escalate, such as in a potential conflict over Taiwan.

How the U.S. can respond

China sees financial technology and cryptocurrency as tools to extend its financial power and surveillance globally. The United States must respond in two ways: export our financial technology and systems worldwide and embrace bitcoin as a strategic reserve asset instead of stifling innovation.

Lawmakers and politicians on both sides of the aisle, most notably President-elect Donald Trump, recognize the power of holding bitcoin on the nation’s balance sheet as a hedge against inflation. This direction would also strengthen U.S. resilience against economic challenges posed by China’s financial strategies.

The Federal Reserve, like many central banks, holds a diverse portfolio of reserve assets. As of 2024, this includes approximately $35 billion in foreign currencies and $11 billion in gold stock. These holdings demonstrate America’s economic strength and provide liquidity during financial stress. However, in our rapidly digitizing world, the absence of a native digital asset in this portfolio is becoming increasingly conspicuous.

With its global reach and growing adoption, bitcoin is the ideal candidate to fill this gap. Often called “digital gold,” bitcoin is a scarce commodity. The U.S. is the largest nation-state holder of bitcoin, having seized 210,000 coins from illegal actors. This gives the U.S. a first-mover advantage and could secure our economic future.

Critics may argue that bitcoin’s volatility makes it unsuitable as a reserve asset. However, this volatility will likely decrease as adoption grows and the market matures. In 2021, El Salvador recognized bitcoin as legal tender and began purchasing it as a treasury reserve asset. They have seen a 100% increase in value and have no intention of selling.

A multi-front war

The U.S. must recognize we are already in a multi-front war with China. One of these fronts is financial services, and crypto is a weapon in our arsenal. Losing this battle means global financial services and individual financial activity would be dominated by adversarial states focused on control, surveillance and dominance — and a continued attack on our currency.

Trump understands this, telling Bloomberg in July, “If we don’t do it, China is going to pick [bitcoin] up.”

Projecting American financial power also requires the government to empower, enable and encourage our private economic sector to interact with contested economies throughout the Indo-Pacific and beyond. Expanding the use of our payment systems, banks and dollars — even where it’s controversial — is essential.

Right now, our adversaries are winning because we aren’t even playing. They are exporting their systems, institutions and surveillance tools worldwide. Meanwhile, we’ve done little as TikTok, a serious threat to our national security, captivates an entire generation of Americans. We must do the same with financial technology because no disruption would be greater to our enemies.

The U.S. should more explicitly weaponize financial technology and crypto. For example, we should endorse decentralized financial technology that enables citizens of hostile governments like Iran to use smartphones to access USD-based stablecoins and payment services, in order to begin separating their economic activity from their government’s control. At its core, power is about control — not just of police or national security but of resources and economies.

The world is at a financial crossroads. The question isn’t whether digital currencies will shape the future but how we will adapt to this new reality. The U.S. can shape this future by embracing bitcoin as a reserve asset. The time for bold action is now, and the benefits for global financial stability and innovation could be profound.