BP Plc plans to sell oil refining and chemical assets in Germany, as the company scales back operations in the country due to high costs.

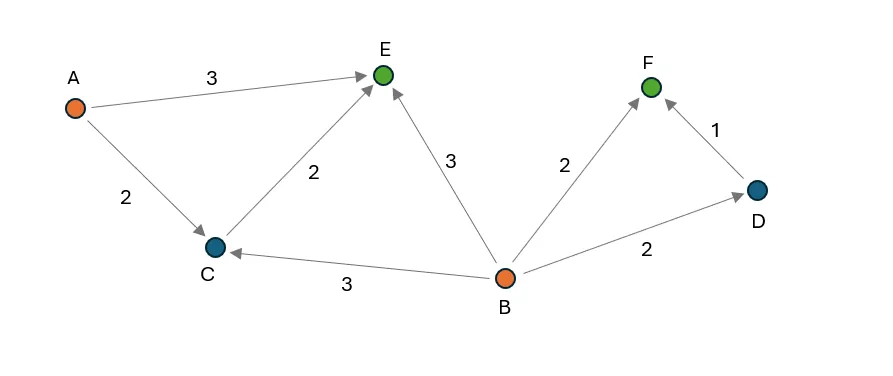

The process, which involves the potential sale of a refinery in Gelsenkirchen and the DHC Solvent Chemie GmbH chemical plant in Mülheim an der Ruhr, will begin immediately with an aim of concluding the sales agreement this year, according to a company statement. The timing of the handover to a new owner will depend on regulatory approvals and operations will continue as usual during the sales process.

European refiners face increasing competition from fuel imports originating in the Middle East and Asia, where capacity is being increased. The continent’s fuel and chemical producing sites have been particularly hobbled by higher natural gas prices and carbon levies relative to other parts of the world, sparking a wave of closures and sales. Slumping fuel margins in the fourth quarter led to disappointing earnings results last week for the world’s oil supermajors as a flood of new output competes with stagnating demand.

The Gelsenkirchen site has the capacity to process 240,000 barrels a day of crude, and is Germany’s third largest refinery.

BP isn’t the only oil major trying to sell out of refining assets in Germany. Shell Plc has been trying to sell its stake in the Schwedt plant, while Exxon Mobil Corp was in advanced talks with shareholders last year to pave the way for its sale of a stake in Germany’s second-largest refinery.

BP previously said it planned to scale back operations at Gelsenkirchen due to high costs at the site and those plans will continue, BP Spokesman David Nicholas said on Thursday.

The sale comes as BP recently announced widespread job cuts with CEO Murray Auchincloss shedding projects that don’t make money or fit into his plans to turn the company around. In a strategy update later this month, Auchincloss will unveil his overall vision for the company. Ahead of that, BP will release its fourth quarter earnings on Tuesday.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR

Bloomberg