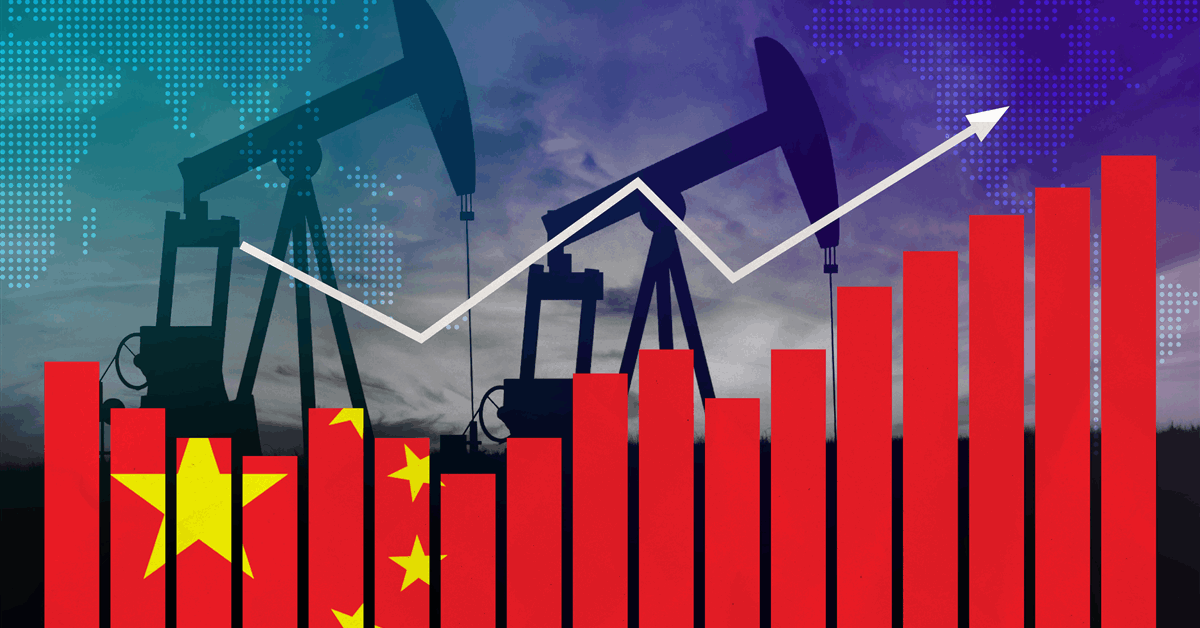

CNOOC Ltd. has set a target of raising its net production to over two million barrels of oil equivalent a day (MMboed) in 2025 while keeping capital expenditure at last year’s level.

Output in 2024 is expected to have totaled 720 MMboe, marking a sixth consecutive year of record highs, the Chinese state-backed company said. CNOOC Ltd., majority-owned by China National Offshore Oil Corp. (CNOOC)., put the total volume goal for 2025 between 760 MMboe and 780 MMboe, of which 69 percent is to come from China.

For 2026, it will aim for 780–800 MMboe. For 2027, the target is 810–830 MMboe, according to a plan it announced Wednesday.

This year, production has been allotted about 20 percent of CNOOC Ltd.’s planned capex of CNY 125–135 billion ($17.15–18.52 billion). Development activities have been earmarked around 61 percent, while exploration would get approximately 16 percent.

Capex last year, when CNOOC Ltd. announced over a dozen production startups mostly at home, is expected to be CNY 132 billion ($18.11 billion).

“The company endeavors to search for large and medium-sized oil and gas fields, to strengthen the resource base for reserves and production growth”, it said. “In 2025, the capital expenditure for exploration in China will mainly be directed to sustain crude oil reserves while expand [sic] natural gas reserves, led by the construction of the three trillion-cubic-meters-level gas regions [in the South China Sea].

“For overseas exploration, the Company will continue to focus on the Atlantic Ocean rim and the ‘Belt and Road’ countries. Drilling will continue in Guyana and rolling exploration is planned in Nigeria. Seismic survey will be conducted in Mozambique and Iraq. At the same time, the company will continue to seek for high-quality acreage, especially operating assets.

“The company will promote exploration and development integration, as well as engineering standardization, to accelerate the conversion of reserves into production”.

CNOOC Ltd. also said it would continue pursuing new oil and gas technology. “Relying on the ‘Hi-Energy’ artificial intelligence model, the Company will facilitate the in-depth integration of digital intelligence technology with the oil and gas business to promote lean management”, it said.

“The company will drive the integrated development of hydrocarbon sector and new energy sectors”.

In 2025, projects expected to come onstream include the Bozhong 26-6 Oilfield Development Project (Phase I) and the Kenli 10-2 Oilfields Development Project (Phase I) in China, as well as the Buzios7 Project in Brazil and the Yellowtail Project in Guyana, CNOOC Ltd. said.

It has already announced two startups this year — the Panyu 11-12/10-1/10-2 Oilfield Adjustment Joint Development Project and the Dongfang 29-1 gas field, both in the South China Sea.

CNOOC Ltd. also said it would expedite offshore wind and onshore solar projects. “Green power substitution will be expedited”, it said. “In 2025, the green electricity consumption is expected to exceed 1 billion kWh, with an increase of 30 percent year-on-year.

“The Company has incorporated carbon price into investment evaluation process, and has been advancing the regional CCS/CCUS [carbon capture, utilization and storage] pilot projects”.

On shareholder returns, CNOOC Ltd. said it plans at least 45 percent in annual dividend ratio for 2025–27 subject to shareholder approval.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR