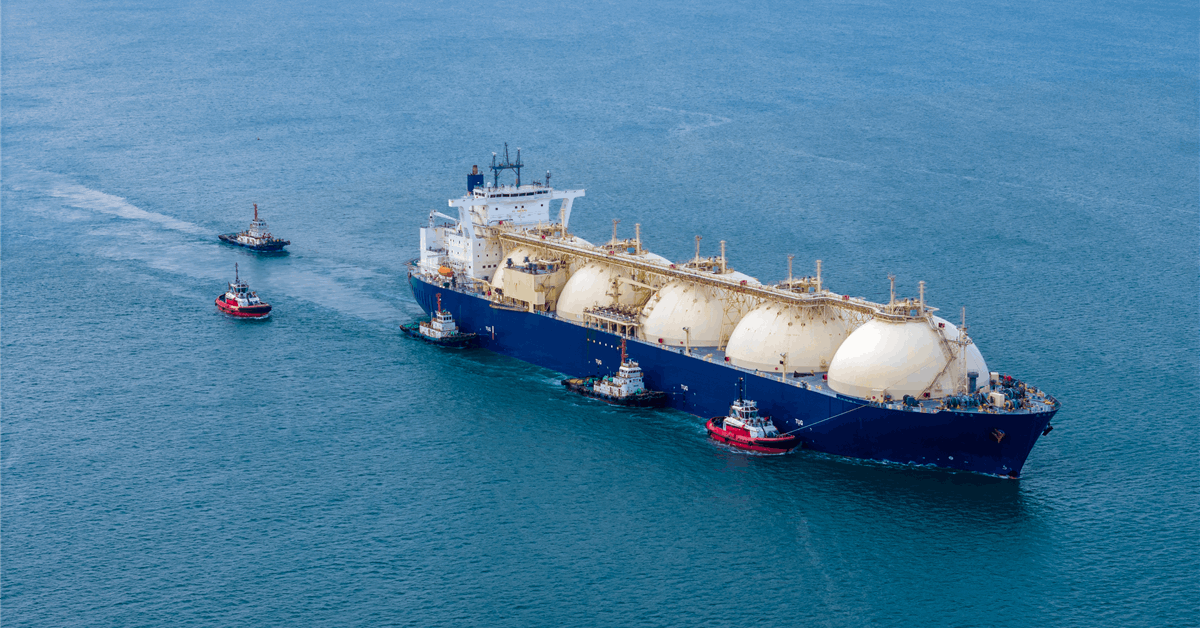

Venture Global, Inc. and Securing Energy for Europe GmbH (SEFE) have entered into an agreement under which SEFE’s subsidiary, SEFE Energy GmbH, will purchase an additional 0.75 million metric tons per annum (mtpa) of liquefied natural gas (LNG) from CP2 LNG for 20 years.

The agreement amends the existing sales and purchase agreement signed by the companies in 2023, increasing the total volume of LNG purchased by SEFE from CP2 LNG to 3.0 mtpa, Venture Global said in a news release.

“Venture Global is thrilled to expand our strategic partnership with Germany and SEFE and play a leading role in ensuring security of energy supply and affordability for not only Germany but the rest of the European gas market,” Venture Global CEO Mike Sabel said.

German state-owned energy firm SEFE is one of the LNG customers for CP2, Venture Global’s third project, in Europe, Asia, and the rest of the world, Venture Global said.

To date, approximately 11.5 mtpa of CP2 phase one has been sold, raising the total contracted capacity for all of Venture Global’s projects to 41.5 mtpa, the company said.

Venture Global said it is expected to become Germany’s largest LNG supplier, with a combined 5 MTPA of 20-year offtake agreements signed with SEFE and EnBW. In addition to its existing long-term agreements, Venture Global has supplied Germany with almost 80 cargoes of LNG from its Calcasieu Pass and Plaquemines LNG facilities, enough to power 8 million German homes for one year.

Last week, Venture Global entered into a new 20-year sales and purchase agreement with PETRONAS LNG Ltd. (PLL), a subsidiary of the Malaysian state-owned oil and gas company, PETRONAS.

Under the terms of the agreement, PETRONAS will purchase 1 mtpa of LNG from CP2 LNG for 20 years. This builds upon Venture Global’s existing agreement with PETRONAS for 1 mtpa of LNG supply from Plaquemines LNG, Venture Global said in an earlier news release.

VGPL Closes $4 Billion Offering of Senior Notes

Meanwhile, Venture Global said its subsidiary, Venture Global Plaquemines LNG (VGPL), has closed an offering of $4 billion of senior secured notes issued in two series.

The first is a series of 6.50 percent senior secured notes due 2034 amounting to $2 billion, and the second is a series of 6.75 percent senior secured notes due 2036 amounting to $2 billion. The 2034 notes will mature on January 15, 2034, and the 2036 notes will mature on January 15, 2036, the company said in a separate statement.

Venture Global said it had previously announced the issuance of $2,5 billion of senior secured notes by VGPL on April 21. This brings the combined aggregate amount of senior secured notes issued by VGPL to $6.5 billion since the project began producing LNG in December 2024, the company said.

VGPL said it intends to use the net proceeds from the offering to prepay certain amounts outstanding under its existing senior secured first lien credit facilities and pay fees and expenses in connection with the offering.

The notes are guaranteed by Venture Global Gator Express, LLC ,which is VGPL’s affiliate. The notes are secured “on a pari passu basis by a first-priority security interest in the assets that secure the existing credit facilities and the existing notes,” according to the statement.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR