Shell PLC on Tuesday announced a final investment decision (FID) to develop the HI field to supply up to 350 million standard cubic feet of natural gas a day to Nigeria LNG.

The project is part of a joint venture in which Shell owns 40 percent through Shell Nigeria Exploration and Production Co Ltd and Sunlink Energies and Resources Ltd holds 60 percent. At Nigeria LNG, which has a declared capacity of 22 million metric tons of liquefied natural gas a year, Shell owns 25.6 percent.

“The increase in feedstock to NLNG, via the train VII project that aims to expand the Bonny Island terminal’s production capacity, is in line with Shell’s plans to grow its global LNG volumes by an average of four to five percent per year until 2030”, Shell said in a statement on its website.

HI also supports Shell’s plan announced on Capital Market Day 2025 to start up upstream and integrated gas projects with a total capacity of one million barrels of oil equivalent per day between 2025 and 2030. It also contributes to the company’s target to grow top line production across its upstream and integrated gas business by one percent per year through the end of the decade, Shell said.

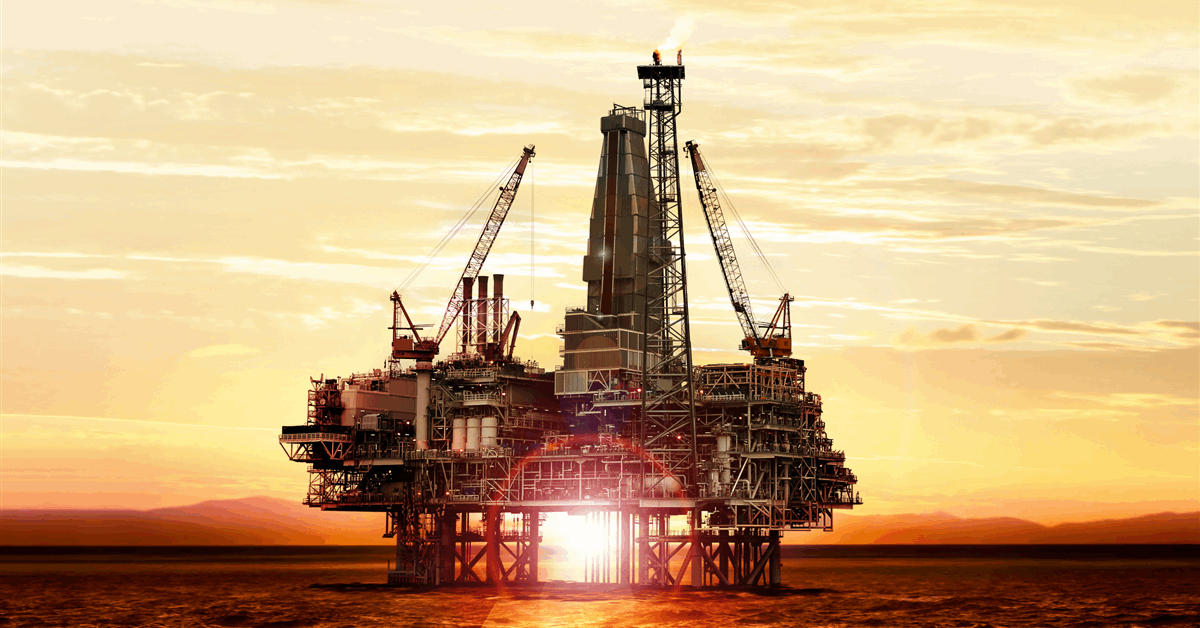

HI is estimated to hold about 285 million barrels of oil equivalent, Shell said. The field, discovered 1985, lies 50 kilometers (31.07 miles) from shore in waters 100 meters (328.08 feet) deep, according to Shell.

The development consists of a wellhead platform with four wells, a pipeline to transport the gas to Bonny and a gas processing plant on the island, from where the processed gas will be transported to Nigeria LNG and the condensate to the Bonny Oil and Gas Export Terminal, Shell said.

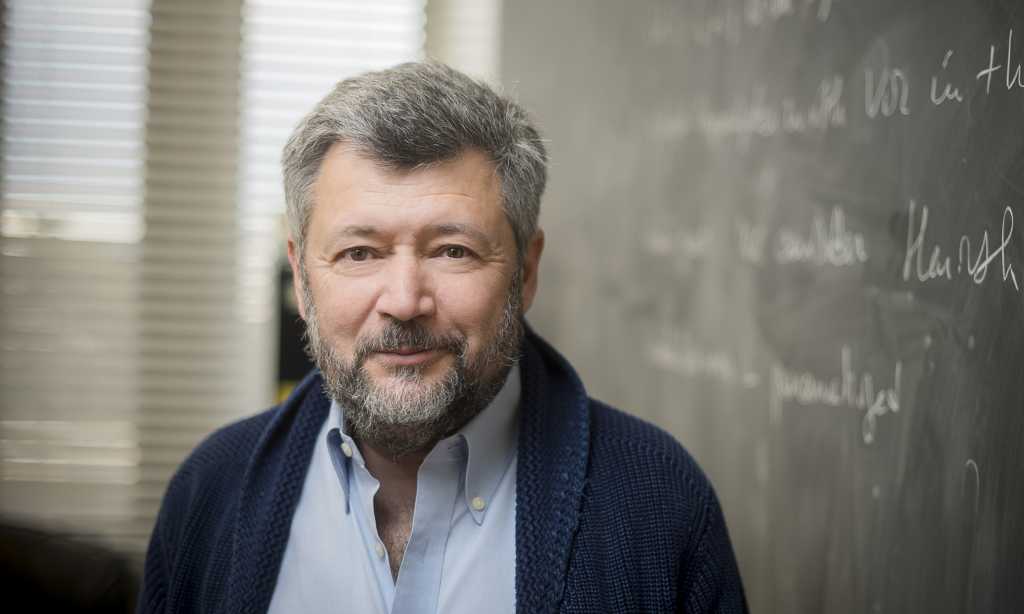

“Following recent investment decisions related to the Bonga deepwater development, today’s announcement demonstrates our continued commitment to Nigeria’s energy sector, with a focus on deepwater and integrated gas,” said Shell upstream president Peter Costello. “This upstream project will help Shell grow our leading integrated gas portfolio, while supporting Nigeria’s plans to become a more significant player in the global LNG market”.

Shell announced a positive FID on the Bonga North deepwater project on December 16, 2024. Shell expects the project to produce up to 110,000 barrels per day, sustaining production at the existing Bonga facility. Startup is planned by 2030.

On May 29, 2025, Shell announced an agreement to acquire TotalEnergies SE’s 12.5 percent stake in the block containing the Bonga field, Oil Mining Lease 118. The acquisition will raise operator Shell’s stake in the license to 67.5 percent.

Earlier this year Shell divested its Nigerian onshore assets to refocus investment in the West African country to deepwater and integrated gas assets.

The sale, priced $1.3 billion, saw Renaissance Africa take over Shell Petroleum Development Company of Nigeria Ltd and consequently acquire a 30 percent operating stake in the SPDC Joint Venture.

“The divestment of SPDC aligns with Shell’s intent to simplify its presence in Nigeria through an exit of onshore oil production in the Niger Delta and a focus of future disciplined investment in its deepwater and integrated gas positions”, Shell said in an online statement March 13, 2025.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR