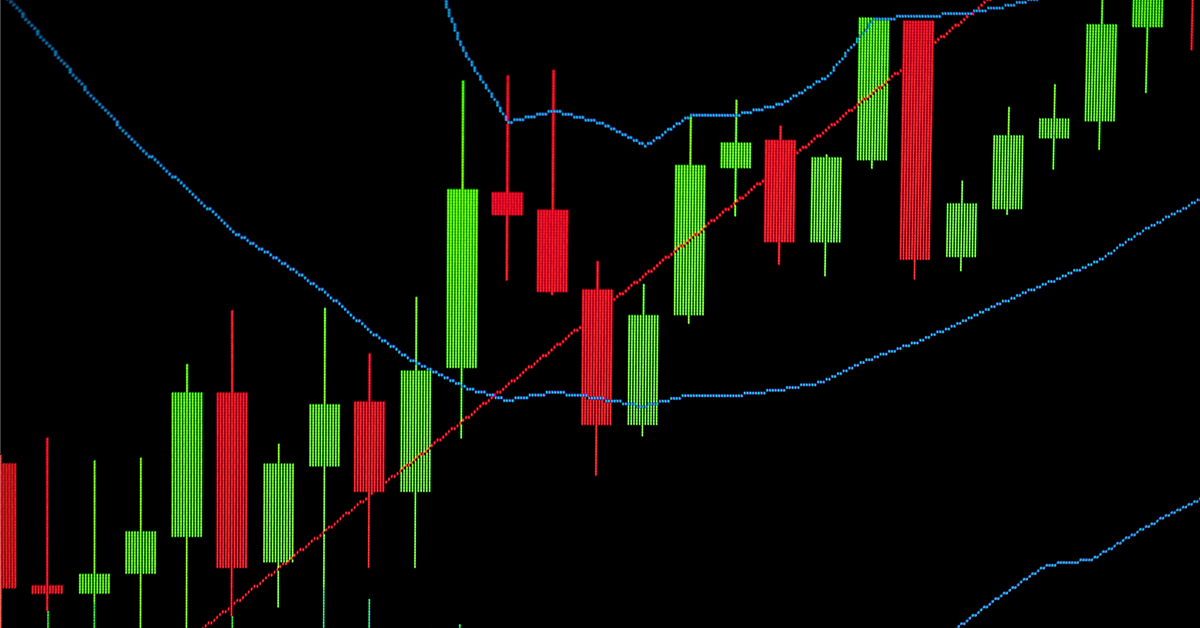

Oil edged up by the most since late July as technical buying supported a rally driven by signs of enduring physical market tightness.

West Texas Intermediate rose 2.5% to settle near $66 a barrel. Ukraine struck two oil refineries in Russia in a continued assault on energy infrastructure that has begun to hurt flows, pushing Moscow’s crude-processing runs to the lowest since May 2022 last month. The conflict has contributed to unforeseen tightness in a market that was expected to be overwhelmed by OPEC crude at this time of year.

Commodity trading advisers, meanwhile, were steadily buying throughout the session, helping push prices higher, according to Daniel Ghali, a commodity strategist at TD Securities. However, the algorithmically driven traders will sell both benchmarks in any scenario for prices over the coming week, indicating that crude’s run may reverse soon, he said.

Russian flows have been in the spotlight over the past few weeks amid US efforts to pressure Moscow to make peace in Ukraine by targeting India, a top importer of its crude. Treasury Secretary Scott Bessent said Washington would look at sanctions on Russia this week. Elsewhere, US stockpiles have remained low at the key storage hub of Cushing, Oklahoma.

The wealth of bullish near-term factors — from the war in Ukraine to the US deploying naval forces off the coast of Venezuela — contributed to timespreads widening in their backwardated structures toward the end of last week.

“Sentiment in the oil market is shifting from very negative to more neutral,” said Arne Lohmann Rasmussen, chief analyst at A/S Global Risk Management. “The main support for oil prices is the geopolitical premium. No one believes anymore that a peace deal between Russia and Ukraine is imminent.”

The jolt of strength comes amid a bearish chapter for crude. US benchmark WTI has largely been confined between $62 and $66 a barrel since early August, with prices almost 10% lower this year. Investors turned the least bullish on crude in about 18 years last week amid widespread concerns that a push by OPEC+ to revive production will swell supplies just as the US-led trade war crimps demand.

OPEC+ will hold a meeting this weekend to decide on output for October. Most market watchers expect that the group will opt to keep supplies steady.

Oil Prices

- WTI for October delivery rose to settle at $65.59 a barrel in New York, up 2.5% from Friday’s close.

- There was no settlement on Monday due to a US holiday

- Brent for November settlement gained 1.5% to $69.14 a barrel.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.